As many of you know we are working extremely hard to create a life of financial independence. The following money-saving hacks have helped us boost our savings and expedite our efforts towards financial independence. Learn step-by-step tips and tricks of what smart people know about saving money fast.

Lots of people desire to be wealthy, however, are unsure of how to go about it. They crave a life of richness but don’t do the little things needed to achieve it.

This article may contain affiliate links, full disclosure here

It’s really easy for people to get caught up in the act of keeping up with the “Joneses”. They don’t stop to consider if purchases are right for them. They assume it’s a good buy just because it’s what’s popular and everyone else is doing it.

Stop, take a moment and ask yourself “Is this something that is really worth my hard earned money”?

Learn to differentiate between what is a want and what is a need. Taking a moment will provide clarity and help you to see if you’re purchase is an impulse or if it’s something that is really needed. If you are looking to save money fast you really need to focus here!

Table of Contents

Don’t worry if the thought of how to save money fast is overwhelming to you

We’ll work through shifting your thought process to help you through this journey. Believe me, changing financial habits will have its challenges, but with a little effort, you can stop making unnecessary purchases and start to build

If you regularly purchase things on credit and are continually maxing out your card you need to recognize these behaviors and develop strategies to deal with them.

A good thing to ask yourself is “if the number of work hours needed to pay off the item is worth the purchase?”

By recognizing if what you’re buying is truly worth the price it’s going to cost you both now and in the future, it will help you make better decisions. I like to break down my purchases into work hours needed to pay the item off. By breaking things down it helps me to remember my priorities and helps me discover new and unique ways of how to save money fast.

Need more perspective? How about this.

I was spending $90 a month on my cell phone bill with Verizon. It made me sick to think I was spending over $1,000 a year for cell phone service! I decided to switch to Republic Wireless, and now I pay a grand total of $360 a year to have a very similar service.

That’s a ton of money I am now saving, and it was a painless transition. The customer service with Republic Wireless is far superior to Verizon. And you can get your own plan starting as low as $10 per month!

By being mindful of frivolous spending behaviors you can implement tips and tricks to help you save money fast along the way.

4 Tips For Cracking Down On Bad Spending Habits

1. Think About Your Goals and Priorities

Why is it you want to save money? Are you looking to put away money for retirement? Are you looking for different ways to save money to buy a car? Do you want the security of an emergency fund? Are you hoping to spend less time working?

By recognizing what’s important to you it will become easier to get to a place where saving money becomes natural.

If your goal is to be a good saver, in the long run, think about the financial freedom you will gain by making small changes now. It can be easy to focus on what you have to give up to save money fast. But if you shift your attitude to focus on what you’ll gain from these small changes, it’s much easier to make the daily decisions needed to get you there.

Related:

- Difference between Traditional IRA and Roth IRA for retirement

- How to make cash in 1 day

- How and why you should start an Emergency fund

2. Remember Why Saving Money Fast Is Important To You

Think about why you want to save money and what the money saved will do for you. Remember your life goals and what financial independence looks like to you. If you need to write it down to work through this feel free to do so.

3. Hold Yourself Accountable

By laying everything out it becomes easier to see what is going on in your life and where you need to tighten things up. Using a simple budgeting tool such as this or a user-friendly app such as Personal Capital you can begin to hold yourself accountable.

Once you have created a budget for yourself, don’t stray from it! Check it over often and find areas where you can reduce or eliminate possible expenses. This is absolutely key when you are looking to be effective at saving money fast.

Related

4. Discover Behaviors That Need to Change

Look at old credit card statements and bills, ask yourself whether those purchases could be eliminated or reduced. Discover trends in your purchasing habits and think of ways to change them in the future. By

Related

9 Money Saving Hacks to Boost Your Savings Fast

1. Spend Less Than You Earn

You have probably heard this many times, but it’s definitely good advice to live your life by.

Learning how to spend less than you make means you can build more wealth for your future. If you don’t spend less than you earn you will never be able to get ahead. Mastering this tip as early as possible will put you on the fast track to financial freedom.

CNN reports that “Nearly half of Americans say their expenses are equal to or greater than their income, according to a new study from Center for Financial Services Innovation. And for that 18-25 %, the percentage is over half, up to 54%

2. When You Get a Raise, Don’t Increase Your Spending

It might seem natural to spend a little more after you get a raise. You start looking at things that are a bit more expensive…. maybe a better car or a larger house. Don’t do it! Put that money into savings. Think of a raise as an easy way to speed up your savings. A raise really is

Many financial advisers claim saving 10% to 15% of your income is sufficient no matter what tax bracket you’re in, but some personal finance writers advocate for saving as much as half of your income if you can.

Tired of getting next to nothing returns on your current banking accounts?

Are you looking for a bank that will make your money work and also help you with saving money fast?

Don’t wait any longer CIT Bank has 22x higher returns than other banks and only requires

Related

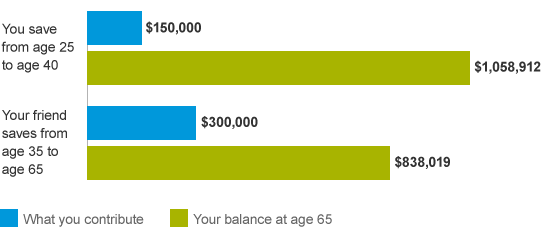

3. Begin Investing Early

If you want to be rich down the road, then start investing now. A perfect tool for new people looking to invest is Swell. We also HIGHLY recommend Acorns which is an app that invests your spare change on the everyday purchases you make.

The earlier you start investing, the more time your money has to grow. If you consistently deposit a portion of your income into a high-interest investment or savings account you will benefit down the road. Small amounts can turn into something huge in twenty to thirty years from now.

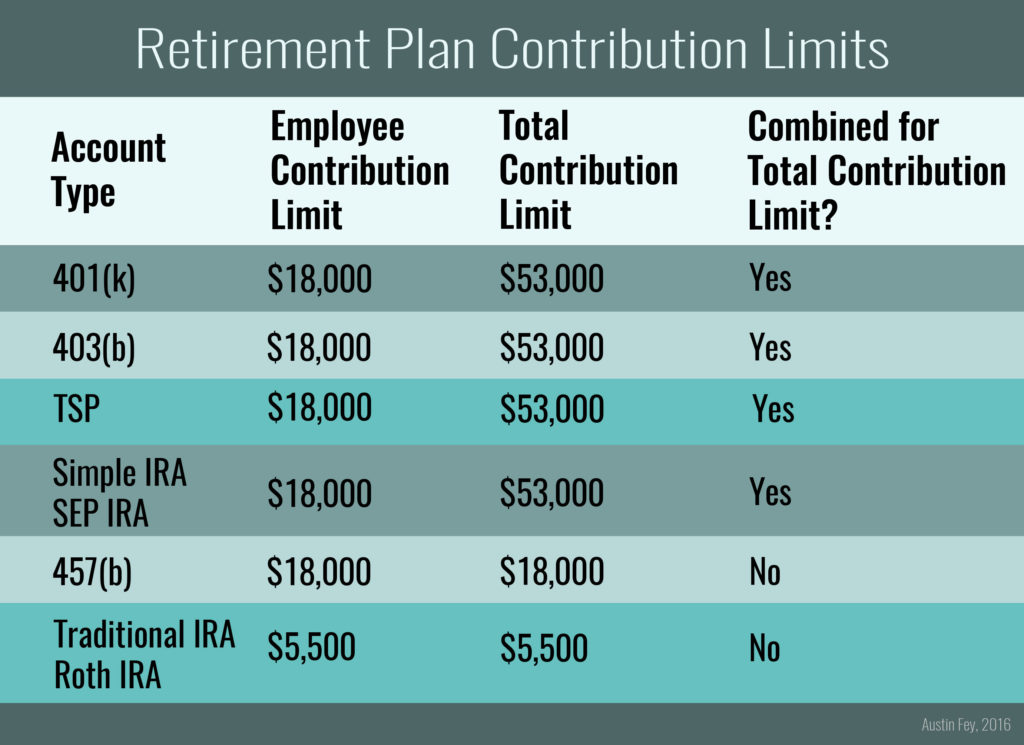

Are you familiar with IRA’s? Do you know the difference between a ROTH and a Traditional IRA? If not you should read this The Difference between a Traditional IRA and a Roth IRA

4. Take Advantage Of Tax-Deferred Savings And Investment Plans

Invest in company pension and retirement plans, 401(k) plans, Roth IRA’s, Education Investment Accounts, stock option programs, HSA’s and whatever else has been approved by the IRS for long-term financial accumulation.

Depositing your money into an HSA can be a huge asset to your retirement plan down the road. Read here about the benefits of having an HSA.

5. Track Your Spending

Always take the time to track all your spendings. This includes utility bills, mortgage/rent payments, grocery receipts, and all payments you make on your credit card. Put the list on an excel sheet to easily identify which ones should be minimized or cut out completely.

Related:

6. Stay Out of Debt

Related:

- 33+ Things to do on a no spend weekend

- 38 Creative ways to save money that you haven’t heard of

- How to use the snowball method to eliminate debt

- How to pay down debt and live a life of freedom

7. Make a Game Out of Saving Money

Saving money doesn’t have to be a chore. Make a game out of it, to keep you motivated! One idea is to try the 52-Week Money Challenge. This is a challenge that requires you to save a certain amount of money each week during the year.

8. Automate Your Money

The best way to grow your savings is by automating your money. Set up recurring transfers on a regular basis from your checking account to your savings and investment accounts.

This way, you force yourself to avoid bad money habits and you save what you would likely otherwise spend.

If you are still paying your bills manually, you might want to consider automating them also. By automating your finances you can automatically pay bills without the stress.

Sometimes you can be your own worst enemy when it comes to financial success. It is too easy to procrastinate and neglect what needs to be done and accidentally accrue charges due to missing payments.

Related:

9. Maximize Contributions into Retirement Accounts

When it comes to retirement account contributions do your best to maximize your contributions. Some employers will offer a match when you put the required percentage of money into that retirement account. That’s free money they are giving you… take advantage of this!

Related

BONUS: Find a Side Hustle

One of the smartest ways to get rich and make money fast is by finding different income sources aside from your day job. Whether you want to get a part-time job or side hustle, the money you earn from this will help you pay off debt and build your emergency funds and savings.

Additional resource: If you’re looking for a simple way to stay on top of all your finances, check out my favorite tool – Personal Capital. This tool is completely free, it allows you to track your spending, monitor your bank and investment accounts, and watch your net worth grow!

Related

- 17 Tips for making money fast

- 18 Easy ways to make cash in 1 day

- Best work from home jobs

- 9 Best online survey sites to make extra money

I hope I was able to motivate and inspire you to get started on growing your wealth. The best time to start is now! The best advice I have is to be patient, persistent and focused on your goals!