This post may contain affiliate links, which means I may earn a small commission at no extra cost to you if you make a purchase through one of these links. Thank you for your support! Read full disclosure.

When you’re in debt it’s really hard to know what your next step is. Many people wonder which debt they should focus their energy on. Should you pay down debt that has the highest interest rate or should you focus your energy on the debt with the lowest interest?

There are some who have the thought that paying the high interest first is the holy grail to getting out of debt. I will say that it does have the potential to save you money but it did not work for me. You know what did work? The debt snowballƒ. The debt snowball method was made famous by financial guru Dave Ramsey.

Have you ever taken a moment to think about how your mind controls your money? Your mind is the key to your ability to dig yourself further into debt or to rid yourself of debt. I truly believe money is a mindset. The debt snowball gives you something to be proud of, something that feels like a win. This is why I feel that the debt snowball is the way to go.

This article may contain affiliate links, full disclosure here

Table of Contents

Reasons why I think the debt snowball is the best

- The debt snowball is easy to understand

- It happens quickly

- The accomplished feeling of crushing debt one after another will help you stay motivated for the long haul

Related:

- How to pay down debt and live a life of freedom

- Learn how to stop overspending and control your money

The Debt Snowball Explanation

I’m sure some of you are familiar with snowy high altitude areas. I am too. I live in an area that gets a large amount of snow each year, I love the accumulation we receive. Perhaps this is why I am a big fan of the debt snowball method. The debt snowball in financial terms works very similar to a snowball on the mountain.

A snowball starts out very small and as it rolls down a mountain it begins to become larger and larger accumulating more and more snow while gaining momentum. By the time this small ball reaches the bottom it has become a firm packed boulder of snow. Sturdy, solid and grounded.

This is how the debt snowball works with your finances also. You start off small and scattered just like the snowflakes. Once you put some effort towards gathering your flakes (money) you can strategically grow your efforts and your momentum. Heck, it works for nature! It has to work for us too right?

How The Debt Snowball Method Works

The goal with the debt snowball is to not focus on your debt as one large balance because that will be way too overwhelming, instead focus on paying off small debts first.

For example, if you have 3 cards each totaling $500, $200, and $800 you want to pay off the card that has a balance of $200 first. Once you have eliminated the smaller debts you realize that this is possible and the drive to pay off more becomes contagious.

Nobody wants their debts hanging around for many years to come so we need to hit this with some focus and motivation.

You must make minimum payments on all debts except the smallest one, the smallest is our focus. This is where we are putting our efforts, we are going to do everything in our power to diminish this debt.

I never said that this was going to be easy so you may have to think outside of the box for various ways to make this happen for you. For some, it may require that you make some extra money. If you need a couple of ideas for making money on the side, this is a fantastic list.

Ready Set Attack! Put everything you possibly can towards your smallest debt. It’s not abnormal for people to look for alternative and creative ways to make this happen so don’t worry if you are getting curious about ways to bring in extra cash.

Perhaps you can sell some of your electronics on Decluttr. People have been known to make good money by selling various items on Etsy, or even dogsitting in their free time. Stay strong and do not let anything get in your way of paying off your debt.

Related:

Why The Debt Snowball Method Works

Remember how I said your mind is a powerful thing? By eliminating your smallest debt you are achieving a huge accomplishment. Your mind likes achievements. It’s part of human nature to like to do things that make you feel good.

It has been proven that people who see results quickly are more likely to stick with something that they sign up to do. No one wants to wait around for years to see results, the longer something takes the more likely it is that the task will be abandoned.

This is why the debt snowball works so well. People become stressed out by financial woes and this method helps you to see that there is a light at the end of the tunnel.

People are able to look at their small debt and not become overwhelmed by the big number. Yes, added all together it can be nerve-racking but this is why it is crucial to focus on one thing at a time. When you eliminate the smallest amount you realize that this is possible and it will not take you as long as you first thought.

5 Steps For Using The Debt Snowball Strategy

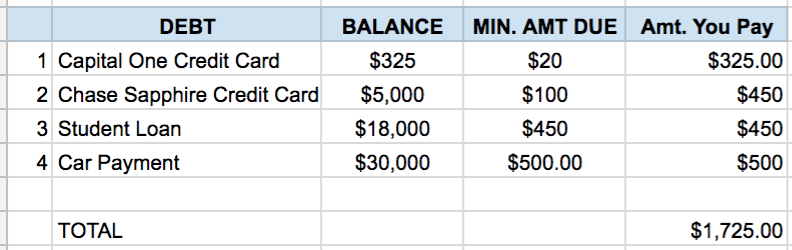

Let’s put this debt snowball into action so you can see how it works for a normal person. We are going to start by reviewing our budget. After looking at your budget you realize you have an extra $650 that is available after paying off all fixed expenses.

In your mind you may be thinking Yahoo! I get to have an amazing night out. Unfortunately, this isn’t the case. We are going to make this money work for you, so let’s get to it!

Related: How To Create A Budget In 8 Easy Steps

Step 1

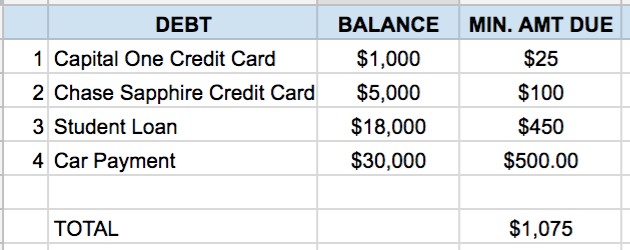

Make a list out all debts (NOT including your mortgage) from smallest to largest regardless of interest rates.

Step 2

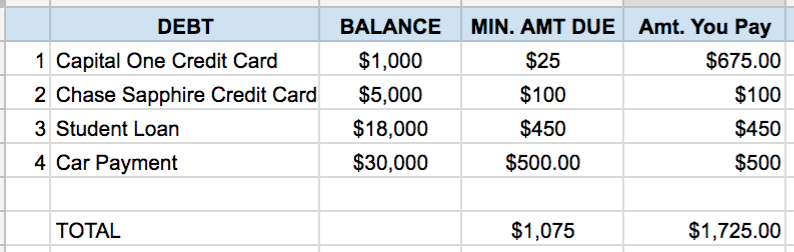

(Month 1) Take that extra $650 you found when reviewing your budget and apply it along with the minimum amount due to the Capital One Credit card (Debt 1).

You will be paying a total of $675.00 to expense #1.

Your balance of $1000 on debt 1 is a lot of money. But that $30,0000 is a TON of money.

By focusing on paying off that $1000 first you begin to train your brain to understand that this is a possible and you CAN do it.

If you can find some extra money in the next month you will see that the $1000 debt has completely disappeared. Goodbye! The achievement of completely eliminating that payment will fuel your fire to continue knocking out the next.

Step 3

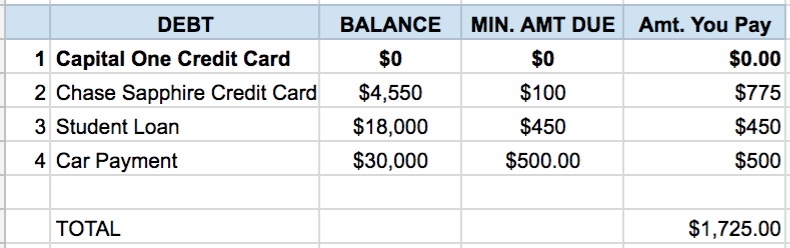

(Month 2) Once again we had a great month and found an extra $650. We will end this month by completely paying off debt 1 and then putting the remaining amount towards debt 2.

Can you feel the momentum? We are starting to get this snowball rolling now.

Step 4

(Month 3) Guess what? Debt 1 is now completely paid off and you can begin focusing your energy on paying off the next. Doesn’t it feel good?

Step 5

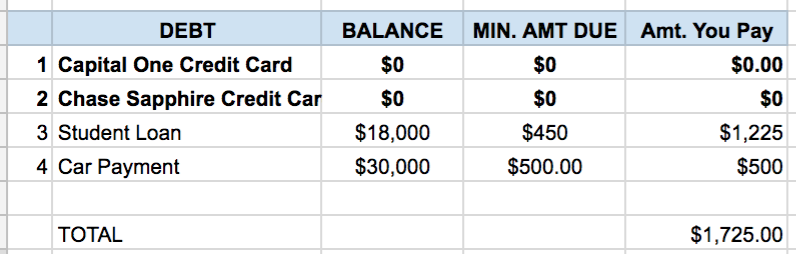

(Six months later). Here’s where the magic begins to take place. You have now completely paid off 2 debts and can begin working on the third. You are being smart and finding alternative ways to bring in some extra money.

Did you know you can even take surveys online during your free time to make a little extra cash? Of course, you won’t become rich doing this but every little bit helps when paying down debt.

Can you see how this begins to roll faster and faster as debts are paid off? Just keep the momentum rolling until everything has been paid off.

Follow us on PINTEREST for financial independence, early retirement, FIRE, budgeting, saving money and frugality

Related:

Is The Debt Snowball Method For You?

I personally think the debt snowball is good for just about everyone battling debt. The boost you receive from eliminating debt is motivating as well as encouraging. However, that being said you need to figure out what works best for you. A plan is only good as the person who “plans” to implement it.

I want to hear from you! Have you had success with eliminating debt? What were your biggest obstacles?