This post may contain affiliate links, which means I may earn a small commission at no extra cost to you if you make a purchase through one of these links. Thank you for your support! Read full disclosure.

For those of you who are new to budgeting, it can seem quite overwhelming to create a budget. I am here to tell you it doesn’t have to be. By following these time-tested budgeting tricks and tips, you will have the confidence you need to be successful.

Don’t let your fear of budgeting get in the way of your financial freedom. Follow these 8 easy steps and learn how to create a budget and save your money.

This article may contain affiliate links, full disclosure here

Before we begin, you will want to download our monthly budget worksheet FREE. Now that you have your budget worksheet, it is time to get started with how to make a budget plan!

Table of Contents

How To Create A Monthly Budget

Find the best method that works for you

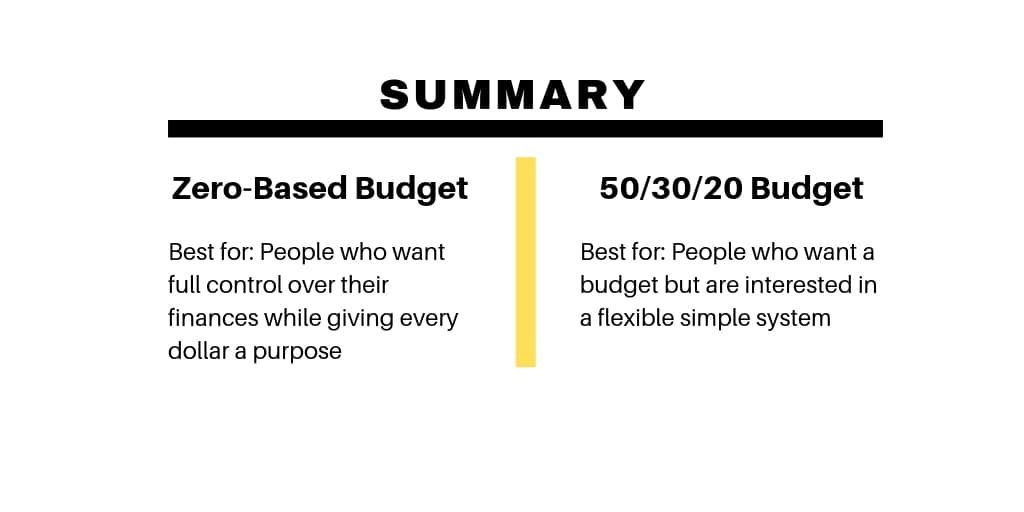

There are many budgeting tools and methods that people use to keep their budgets on track. I’ve summarized 2 of the most popular methods below. Consider your personality and choose the one you think you will be the most successful with.

The Zero-Based Budgeting Method

Best for: People who want full control over their finances while giving every dollar a purpose

Zero-based budgeting is an open and transparent way of creating a budget, it encourages you to use every penny of your monthly income.

With the zero-based budget, every dollar is assigned a job. If you have $3,000 of monthly income and only $2500 of expenses, you aren’t done. You must find a job for that remaining $500.

Have you created an emergency fund? Are you saving for retirement? What about your child’s future? The goal here is to create budget categories and assign values until your income minus your assigned costs equal zero.

This method takes a bit of time and organization up front. But by categorizing every expense there are fewer mishaps and expenses you hadn’t planned for. By using this method users gain the confidence needed to gain control of their finances.

This is our preferred method of budgeting. It takes a bit of work in the beginning but it is a very powerful budgeting system that will allow you to create a budget while saving for your future.

This article is part of our eBook series you can download below

50/30/20 Budgeting Method

Best for: People who want a budget but are interested in a flexible simple system.

Essentially, you’ll spend:

- 50 percent of your income on living expenses (rent, mortgage, groceries, bills transportation, etc.)

- 30 percent of your income on wants and lifestyle choices (fun and entertainment, dining out)

- 20 percent of your income toward debt payments and saving.

This method doesn’t account for the exact dollar spent on each monthly expense. It is indifferent to your car payment versus your cell phone payment.

The benefit of the 50/30/20 is the simplicity and that there is some give and take when it comes to your budget since no one category is static. Your total spending each month can be different but as long as your spending fits within the broader 50/30/20 guidelines you’ll reach your goals.

Zero-Based Method

Step 1. Track Your Spending

If you haven’t taken the time to track your spending and evaluate your expenses now is the time to do so! Understanding your spending habits is crucial to effectively manage a budget. Get your accounts in order by signing up for online access to all of them.

Think about your style and what budgeting tool will work best for you. Perhaps you like a simple budgeting worksheet along with pen and paper.

Or maybe you are a bit more computer-oriented and would prefer to create a budget online using a FREE budgeting software program such as Personal Capital. Personal Capital is an excellent option for those following the Zero-Based Budget. It allows you to set spending targets and alerts you of your progress throughout the month.

It also automatically breaks expenses down into categories so you can easily see where your money is going. I’ve been using Personal Capital for the last several years and have had great outcomes

You first need to know where your money is going before you can create a budget.

2. Calculate Your Monthly Income-After Tax Take Home Pay

Every good budget starts with knowing your income. Income is the dollar amount you take home from your salary each month.

Take a look at your paychecks, if you receive the same amount of money each month this step is easy.

If your pay varies month to month I recommend gathering 3-4 months of income adding them up and dividing that by the number of months. This will give you your average take home which is a good place to begin.

Please remember to include all sources of money coming in such as rentals, or side job income.

On the budget spreadsheet, you will list all income sources line by line.

Example

Income

- Monthly Take home pay from Job: $3000

- Rental Income: $400

- Side job income: $200

3. Understand What Categories Your Debts Should Be Grouped Into

Learning how to create a budget is all about getting real about your expenses. By taking a bit of time in Step 1 and tracking your expenses you will be better equipped to strategically create a budget that will work for you.

You want to be able to include all expenses that are related to one another. Knowing how to categorize these expenses is important.

Here’s an idea of what items are included in a personal budget

Expenses

- Housing includes: Rent/Mortgage, HELOC, Homeowners insurance, Homeowner dues (association fees), and repairs

- Utilities include: Water, sewer, gas, electricity, and garbage pickup

- Automotive includes: Car payment (loans), car insurance, fuel, and repairs

- Medical includes: Insurance (health, vision, and dental), prescriptions, and co-pays

- Debt includes: Credit Card Debt, Student loans, credit card debt, and personal or bank loans

- Food: Groceries

- Communication services include: Cellular phone, home phone, and Internet

- Entertainment includes: Extracurricular spending, date nights, eating out, Satellite, cable

- Personal Care: Salon/hair care, clothing.

- Childcare includes Babysitters, daycare, nanny, after-school care.

- Financial Goals: Retirement Accounts, HSA, Emergency fund

Step 4. Determine Fixed Expenses

Next, we will assess our fixed monthly expenses. Fixed expenses are expenses you must pay each and every month.

Examples of fixed expenses include rent/mortgage, electric, water, sewer, insurance, vehicle payments, trash, groceries.

For those who have payments that vary from month to month such as a power bill or groceries take the average of 3-4 months worth of statements to determine your actual payment.

I would also recommend that you look at the months of highest utility usage. For example, if you use more propane in the winter months you may choose to use that amount as the base for your budget. I prefer using this method because you will be in the positive rather than fall behind because of a higher than expected bill.

For some who aren’t familiar with creating a budgeting, this part can be difficult and even stressful. However, it’s really important that your amounts are as accurate as possible.

Example

Expenses

- Mortgage: $1000

- Health Insurance: $30

- Car payment: $400

- Car Insurance: $50

- Electric: $65

- Water: $20

- Trash: $10

- Groceries: $400

Please do your best to include all monthly expenses separately line by line. Take note of the amount that you are paying to each service monthly. If you choose at a later date to group items (Water/Sewer) that is up to you. However, by listing items separately it increases your awareness of the expenses you have.

I know you are probably thinking to yourself. Uummm excuse me….. You have forgotten a couple of very important monthly expenses such as entertainment, clothing, vacations, gifting. Don’t worry we will get back to those items after we set some GOALS!

[click_to_tweet tweet=”How to Create a Budget in 8 Easy Steps” quote=” How to Create a Budget in 8 Easy Steps”]

Step 5. Financial Goals

The reason setting goals are so important is because it allows you to stop and prioritize what is important in your life.

So, take a pause and write out some of your goals. Get specific, think of what you want your life to look like. Envision your financial portfolio and the life you want to live.

Do you want to be debt free? Do you crave financial independence? Do you want to build an Emergency Fund? Do you want to save for a downpayment on a house? For us, our goal is to achieve FIRE (Financial Independence Early Retirement).

After you have taken a moment to determine your financial goals think about the amount of time it would take you to achieve these particular goals. Are they long-term goals? Short term goals? How much do you imagine you should save for each goal?

After you have identified the goals you want to pursue consider them an expense that you will factor in monthly. By creating this mindset you will develop the habit of saving for the goals you create in your life.

RELATED

[click_to_tweet tweet=”Make your financial goals an EXPENSE!” quote=”Make your financial goals an EXPENSE!”]

As you slowly save money for the goals you have created you will begin to feel empowered knowing that you are in control of your future.

Your expenses may now look like this:

Example

- Mortgage: $1000

- Health Insurance: $30

- Car payment: $400

- Car Insurance: $50

- Electric: $65

- Water: $20

- Trash: $10

- Groceries: $400

- Emergency Fund $100

- Retirement account: $100

- Health Savings Account (HSA) $100

This is probably a new one for you but hear me out. Try to look at everything that is coming out of your checking account as an expense. This may help to clear up any confusion when trying to differentiate between an expense vs income.

I want you to shift your mindset from thinking of your emergency fund, and retirement account as “savings accounts,” rather think of them as expenses. By thinking of these accounts as expenses similar to all other expenses in your life you will create big opportunities for your future. Some people refer to this as “Paying yourself first.”

As mentioned above you are probably thinking to yourself. “Hey what about the fun and entertainment budget?” Here we go! These items are called “discretionary expenses”.

Related

Step 6. Discretionary Expenses

Discretionary expenses are only factored in after you have prioritized your fixed monthly expenses. Discretionary expenses are optional and non-essential for your living. These can be adjusted based on your income and expense ratio.

By including expenses from above and now adding in discretionary items your budget may now look like this:

Example

- Mortgage: $1000

- Car payment: $350

- Electric: $65

- Water: $20

- Trash: $10

- Emergency Fund: $100

- Retirement account: $100

- Groceries: $400

- Health Savings Account (HSA) $100.

- Entertainment: $150

- Personal care: $50

- Other: $175

Wow! We have collected a lot of data. Try not to limit yourself too much with your discretionary items. I would rather you aim high and have money left over than aim too low and break your budget the first month.

Step 7. Finding Your Budget Number

Here is the “exciting” part. Using a budget calculator app or simple pen and paper. Total your income and expenses. Then subtract your expenses from your income. What’s your number? Positive or negative?

Positive number: Means you make more money than you spend and you haven’t spent everything you make. Good job! Your option here (the most responsible one) is to increase your contributions to your savings, emergency fund, or retirement account.

Negative number: You are spending more than you earn. Ouch!! You will need to adjust your budget by cutting some of your discretionary items. OR you can increase your income by finding a side job to subsidize your lifestyle. It is very important when cutting expenses you are mindful of the goals created in step 5.

Related

Do not decrease your emergency fund “expense” to be able to afford going out with friends to the cocktail lounge. This is not a responsible decision.

Some of you may need to make some major changes to your budget.

After you have cut back where you can and reevaluated your budget. Ask yourself if every dollar is being accounted for? Are you still negative? Do you need to make additional adjustments?

- For example, we found we were paying WAY too much for the internet. I was able to call the internet company and get our bill cut in half by asking!

- Cell phones are becoming a huge expense for many people. Make sure you are shopping around for better cell plans. There are lots of other options now competing with the big 3. Republic Wireless is one that we’ve been very happy with.

Step 8. You Have Created A Budget Now What?

First of all-Good job! Budgeting is a long-term game. You now have a solid budget you can implement and move forward with. Adapting to this new lifestyle can be challenging the first couple of months, but stick with it. Continuously refer to it, monitor it, and adjust it as needed. It will be worth it!

I recommend you revisit and update your budget on a regular basis. Schedule a “meeting” with yourself or your family monthly to re-evaluate how things are going. By doing this it will help you to stay on track and keep your budget fine-tuned. The key to being successful with your budget is practicing consistency!

Want to remember these 8 steps to creating a budget? Don’t forget to pin to your favorite Pinterest board HERE

Follow us on PINTEREST for financial independence, early retirement, FIRE, budgeting, saving money and frugality

Do you have any other tips for creating a budget that you can share? We are always interested in hearing how others budget their finances.