This post may contain affiliate links, which means I may earn a small commission at no extra cost to you if you make a purchase through one of these links. Thank you for your support! Read full disclosure.

We love finding ways to trim our costs and simplify our living. We realize that every attempt to cut back adds up to a good chunk of savings. If I told you you could reach financial freedom 5 years sooner by cutting out unnecessary items from your budget would you do it?

Table of Contents

Read On And Learn The 17 Things That Are a Waste of Money.

This article may contain affiliate links, full disclosure here

1. Checking Account Fees

Banks can be notorious for charging checking account fees, but with just a bit of diligence, you can easily avoid them! Below are the most frequently encountered reasons for why banks charge these costs:

- Paper statements

- Not having minimum balance in account

- Not enrolled in direct deposit

If you’re paying checking account fees, don’t waste any more of your hard-earned money. Reach out to your bank today and discover how easy it is to do away with these charges!

It could be something as straightforward as ditching paper statements or signing up for direct deposit – which can take just five minutes at the most – and you’ll save yourself from having to pay those pesky fees anymore.

Let’s explore all the things that are a waste of money and how you can save $50 or more

But first, make sure you have a spending tracking App. It’s crucial to understanding where your money goes and where you need to save. I promise it will make a big difference in how you save. We use and swear by Personal Capital check it out it’s FREE.

2. Gym Memberships

If you are one of those gym rats more power to you! However, if you can’t remember the last time you stepped foot in a gym it may time to ditch the membership.

There are so many options for working out without having to pay monthly fees to a gym. Going outside and getting some fresh air is my favorite choice for exercise.

If you are looking for motivation try following Melissa Bender she’s one of my Youtube favs. If you are interested in other options, here is a list of some of my favorite phone apps.

- Nike Training Club – iPhone, Android

- Cody app

- Meetup – Is a great way to meet like-minded people in your area for any sort of exercise that you may be interested in. For me, this is a great way to keep the motivation flowing.

3. Bottled Water

Is it really worth the expense to you? Getting a bottle of water at the gas station or coffee shop is $1-3. We purchased a Brita water filter for our house. Now we can enjoy filtered water without the cost.

C’mon people, this is such an easy change to make yet so many people continue to buy water. In addition, it’s the right thing to do for the environment. Join the No Plastic is Fantastic challenge!

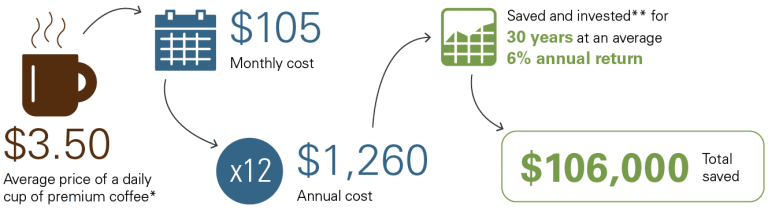

4. Fancy Coffee

While it might not seem like a lot when forking over $3.50 for your fancy coffee, trust me it is.

One of the best ways to save some money without having to get rid of your coffee habit is by brewing your own cup at home. If I told you by giving up this simple convenience you could retire 5 years earlier. Would you still buy that coffee? It’s a no-brainer!

You can get yourself a good coffee maker at a decent price and save tons of money. Almost all coffee makers now have built in timers, set it before you go to bed so you can have a fresh brew ready when you wake up.

We keep an AeroPress with us wherever we go, at work, on the road, overseas, you name it we have it. Makes a great cup of coffee and packs small.

[click_to_tweet tweet=”Would you like to retire 5 years earlier?” quote=”Would you like to retire 5 years earlier?”]

5. Excess Electricity

This is simple, but something that you can save money on each month. Turn off your lights when you’re not using them. Unplug things you rarely use. Ex. Treadmill, printers, and toasters. It all adds up and it all compounds if you put that money into savings.

Pay attention to your power bills if you notice a spike in your bill take the time to make sure your house is adequately insulated. If you can afford it, consider installing quality windows or doors.

RELATED:

12 Proven Ways To Save On Electricity That All The Pros Know

6. Men’s Haircuts

This took a bit of courage but after watching a couple of youtube videos on “Basic Men’s Haircuts” I was off and running. My husband was beginning to pay a good amount of money for a simple haircut so I found a solution. Here’s a helpful tutorial if cutting hair is new to you, How to Cut Hair.

7. Pre-Packaged Foods

Everything is focused around convenience. Many grocery stores are expanding their pre-packaged food sections to make things quick and easy.

My suggestion is to opt for healthy food options that are not pre-packaged.

Your pre-packaged fruits and veggies are likely costing you way more than if you bought these foods whole and cut them yourself.

Apple slices? I found apples at the store for $1.39 a pound, whereas pre-sliced apples added up to $4.96 a pound. Celery sticks? I can buy a whole bag of celery for $1.49 or I can buy one small container of pre-sliced sticks for $1.99 each.

Again, if I told you, you could reach financial freedom several years sooner for the lack of pre-sliced convenience. Would you still buy it?

8. Driving To Work

Search for alternative methods such as public transportation, carpool groups, or even better ride your bike, jog, or walk.

Not only does driving cost you gas money but it costs you wear and tear on your vehicle.

Tires, Oil, and miscellaneous items such as wipers and maintenance should also be factored in.

What if your workout was your commute? How nice would that be? More and more places of employment are offering convenient shower facilities so that people can commute to work. If your place of work doesn’t offer this it’s time for a conversation with management to see about this addition.

Every study on this topic shows huge returns on investment for the company in terms of increased employee productivity.

9. Eating Out For Lunch

Purchasing lunch can really begin to add up. The cost of going out to eat can vary – you may spend $5 on a sandwich or you may go to a restaurant and spend $20.

At our house, we always make enough dinner the night before to pack a healthy lunch for the next day. Packing food has the potential to save the average person at least $100 a month.

Again what’s convenience really worth to you? I’ll take the early retirement, thank you very much.

10. Extended Warranties

Purchasing extended warranties are rarely worth the money. Most of the time products are unlikely to need repair during the warranty period. In addition, the cost of repairing the item may be similar, or even less than the warranty itself.

A better option to extended warranties is putting that money towards in an emergency fund to help you pay for repairs or replacements down the road.

11. Cable TV

Cable can be outrageously expensive and guess what? A Waste of Money. The average package comes in at $100 a month. That’s a large sum to pay for a service that people often don’t take full advantage of.

Consider cutting the cord and using Netflix, Hulu, or Amazon Prime. Take advantage of the 30 day free offerings of both Amazon Prime and Amazon video.

12. Name Brand Items

Purchasing name brand groceries over generic can really add up over time. Choosing the cheaper option can result in over 25% savings. Based on this price comparison, a person can save at least $60 when choosing the generic brand over name brands each month.

In most cases, the ingredients are pretty much identical in generic vs name brand items anyhow.

Also, if you have prescriptions always ask the pharmacist if there is a generic version of your medication. The generic vs name brand works just the same at a fraction of the cost.

UPDATE: We recently starting using Brandless and absolutely love it. Never heard of Brandless the organic, fair trade, vegan and so much more online retailer before? I am so excited about this company, everything they sell is only $3.

They are able to keep their prices low because they are Brandless and have cut out the “Brand Tax” that comes with some of the big name brands out there.

They have tons of high-quality products at only $3! A couple of our favorites are organic jerky, organic agave nectar, and organic maple syrup. Do yourself a favor and check them out.

I think the best part of Brandless is that with every order placed they donate a meal through their partnership with Feeding America. How cool is that?

13. Cleaning And Laundry Supplies

With a few exceptions such as wood and various upholstery materials, you don’t need to buy specific and often pricey products to clean every different surface in your home.

There are a lot of ingredients in your home that can be used to make for great cleaners at a fraction of the cost. Vinegar is a great all-purpose cleaner. Baking soda is gentle enough to use as a mild abrasive in many areas of your home. Lemons have a natural bleaching ability.

Making your own cleaners can be a great way to cut cleaning costs. It’s easy to find recipes for DIY all-purpose cleaners on the cheap like this one, as well as homemade cleaning products for specific surfaces if the need does arise.

Related

14. Credit Card Late Fees

Following right behind interest on a high balance credit card, another money sucker is the fees associated with using one’s debit/credit cards.

Even if you are only slightly late in making payments, these delayed payment charges can add up to quite a hefty sum of between 30 and 50 dollars!

There’s no point incurring that expense when it’s already necessary to make your bill payments timely – so don’t let those unnecessary costs take away from your hard-earned money.

15. Convenience Stores

Even though there is great value in being able to purchase items quickly from a convenience store, the true cost of this “convenience” must be taken into account.

To maximize your savings and get the most out of every dollar you spend, it’s important to plan ahead and make purchases well in advance whenever possible.

Consider buying snacks at the grocery store instead of stopping by a convenience store when you want something to eat or drink. It’s much more cost-effective in the long run; for instance, purchasing large packs of pretzels might be three to four dollars but paying two to three dollars per bag at quick marts can add up quickly if done often enough.

16. An Expensive Cell Phone Plan

Have you heard of Consumer Cellular and their inexpensive cell phone plans? They offer cell phone plans with no overages, no activation fees, no roaming charges, and no contracts.

You can easily switch your plan up to twice a month if you need to. Consumer Cellular rates start at $15 for unlimited talk and text and $5 per GB of LTE cell data!

- If you are looking to sell your old phone and make good money Gazelle offers a great service for selling them quickly and easily. In addition, Gazelle has amazing customer service and takes the hassle out of getting rid of your old phone.

- We have been using Gazelle for the last 3 years and have never had a bad experience.

[click_to_tweet tweet=”Would you like to retire 5 years earlier?” quote=”Would you like to retire 5 years earlier?”]

17. Buying Storage Baggies

Investing in reusable food containers is a great way to save money over time and reduce your reliance on single-use baggies. Reusable containers are just as convenient, but you don’t have to keep buying them!

With growing concern of chemicals found in plastic containers, glass ones have become increasingly popular. Not only are they safer and more durable, but opting for glass will also save you money over single-use baggies and disposable plastics. Investing in a few quality sets of reusable glass food storage is an easy way to reduce your environmental footprint while still saving time and money!

While you don’t need to completely give up on purchasing baggies, you should consider replacing them with reusable food containers. Not only will this help your wallet, but it’ll also lessen the plastic waste that ends up in landfills.

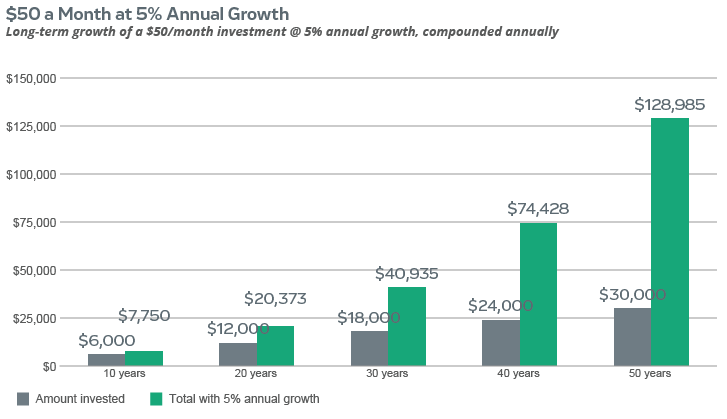

Here’s Why Every Dollar Counts

People have a hard time understanding compound interest. Forward-thinking just doesn’t come naturally. I want to emphasize the importance of freeing up just $50 per month and the impact that can have over the years.

Only $50 a month! These numbers are on the conservative side and more of a worst case scenario as you can certainly do better than 5%. Start using the Acorns app and save every time you spend.

You can see that as you approach 20 years your money has almost doubled. That $50 a month turns into $100 per month without you having to do a thing.

Want to learn more about Compound Interest and why it could be your best friend? Here’s a great article to get you started.

How To Avoid Wasting Money

Now that you have learned where you can cut costs and save more money each month, here are a few places to put that extra money. You really can’t go wrong with any of these.

Want to remember these 17 things that are a waste of money pin them to your favorite board here

As always, thanks for tuning in

Don’t forget to share and pin for later! While you’re there, I’d love for you to follow me on Pinterest