You have been working hard stashing away money and you think you want to buy a house. But before you get too far have you ever researched what it takes to buy a home? Fear not. After reading this guide you will know everything you need to know about buying your first home.

We’re going to cover what a mortgage is, the process of achieving a mortgage, and how to find the home of your dreams.

Table of Contents

1. How Can I Prepare To Buy a Home?

Before buying a home the first step is figuring out how much you can afford and how you’ll pay for it. Since a home is one of the most expensive things you’ll probably ever buy this step is really important.

Mortgage Affordability Calculator

A good way to get started is to use an online mortgage affordability calculator to estimate what you will pay. There are a lot of costs that go into an accurate mortgage calculation so you want to make sure you pick the best mortgage calculator to give you a good idea of everything involved.

Prepare Your Finances For Buying A Home

The last thing you want to do is get your hopes up for buying your dream home only to discover you really don’t have the funds to do so. To guarantee you are financially ready take a good look at your budget and understand how much house you can afford.

RELATED:

- How much house can I afford without becoming house poor?

- Best Mortgage Calculator-Even Factors Extra Payments

Check Your Credit Score

If you are a first-time homebuyer with bad credit you are going to want to pull your credit from AnnualCreditReport.com to see where you stand. You may be able to get approved if you have a low score but you will receive much better interest rates if you have a good score.

Even if you aren’t worried about your credit score I recommend checking it anyway there could be an error on your report that could be quickly resolved by disputing it through a company like Credit Karma.

Improving your credit score isn’t impossible, but it takes a bit of time and effort on your part. If you have a poor score don’t be surprised if your lender asks you questions about items on your report. Your lender is ultimately trying to help you get the best loan possible so every little bit of information you can provide helps them to understand your creditworthiness.

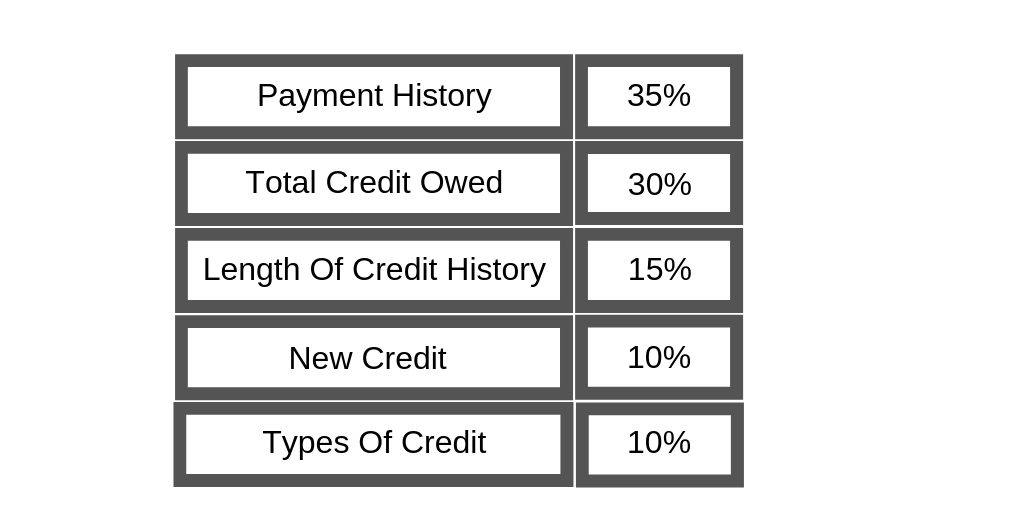

Here are the factors that influence your credit score:

Don’t Take Out Any New Loans

Once you begin to enter the home buying process it is really important that you avoid taking out any new loans. Taking out a new loan can affect your debt to income ratio which can affect the amount of money a lender will loan you for a mortgage.

Make Some Extra Money For A Down Payment

If you are able to put a good chunk of cash towards a down payment (20%) you can avoid paying for additional insurance (PMI) which we will discuss later.

Another great reason to put as much money down as possible is that you will significantly reduce the amount of interest you will pay in the long run. Wouldn’t it be nice to pay off your house in 15 years rather than 30?

If you are looking for ways to come up with extra money for your down payment you can either cut back on unnecessary expenses or pick up a good paying side gig. Here are a couple of ideas to get you started on your path to becoming a homeowner sooner:

- Walk dogs with Rover

- Teach English to students in other countries

- Take easy online surveys

- Start your own business online

2. Understand What A Mortgage Is

A mortgage is a loan. But not just any loan it’s a loan given to you by either a bank or a lender to finance your new dream home. Taking out a loan is a risk for both you and the lender you are loaning money from. However lucky for the lender they have one huge guarantee you should you default or your payments. Your house. Yep! Your house is used as collateral in exchange for the money you are borrowing to finance the mortgage. Learn everything you need to know about which mortgage is right for you here.

RELATED:

3. Understand the Pre-qualification and Pre-Approval Process

What Does It Mean To Be Pre-Qualified?

Getting pre-qualified to buy your

It’s almost like one of those dating apps, where you create a profile just to see what possibilities are out there. You’re really not ready for a date you just want to “see” what your options are.

Pre-qualification is fairly simple. Your lender will perform a very basic review of your financial situation to give you a general idea of how much you are able to borrow. Pre-qualification can be done over the phone or on the internet, and there is usually no cost or commitment.

Becoming Pre-approved To Buy A House

Ok, we are getting serious now. So in this next step, we are taking it to the next level by providing your bank with the necessary documentation to perform an extensive background check and get your current credit rating to buy your first house.

During this process, most people feel like they have given the lender everything they could possibly ask for and the lender always comes back asking for additional information. One more pay stub, one more W-2!

Sometimes this process requires you meet with your lender face to face to fill out a mortgage application and pay a fee showing your commitment level. After your lender has done the necessary background work they will provide you with an idea of the interest rates that you can expect on the loan. They will also give you a conditional commitment in writing for an exact loan amount, allowing you to look for a home at or below that price level.

Here is a list of documents your lender will need to pre-approve you for a loan to buy your first house:

Employment info

- Name of current employer, phone and street address

- Length of time at current employer

- Position/title

- Salary including overtime, bonuses or commissions

Income

- Two years of W-2s

- Profit & Loss statement if self-employed

- Pensions, Social Security

- Public assistance

- Child support

Assets

- Bank accounts (savings, checking, brokerage accounts)

- Real property

- Investments (stocks, bonds, retirement accounts)

- Proceeds from the sale of your home

- Gifted funds from relatives

4. The Search For Buying Your First Home Is Real

Now that you have taken the time to learn how much you can afford and are aware of your approval amount the search begins. You start looking for that perfect match for you and your budget.

Take your time and don’t jump into something that you aren’t in love with. This process can take a while so don’t worry if you find some duds. You have to filter out the duds to find the home of your dreams.

Things To Consider When Buying a House

- What kind of neighborhood do you want to live in? Trendy neighborhoods close to downtown corridors are going to be much more expensive than outlying areas. You may be able to find an equally lovely house at a fraction of the cost 15-20 minutes outside of the city.

- If you have children you will want to consider the school districts your children will be enrolled in.

- How long do you plan on living in this home? Buying and selling homes can get expensive. There are closing costs and realtor fees that need to be considered. Most experts recommend that you live in a home for at least five years to allow your home to appreciate to get the most bang for your buck when selling.

5. Choosing The Right Mortgage

Mortgages come in many forms. The main difference between most of them are the terms of the loan and how the interest rate is calculated.

Fixed Rate Mortgages

Fixed rate mortgages are often times called traditional mortgages. With a fixed rate mortgage the borrower pays a “fixed” interest rate for the life of the loan. The interest rate never changes from the first mortgage payment to the last.

Most fixed-rate mortgages have a 15 or 30-year term. If interest rates rise, the borrower’s payment does not change. The shorter the period of time on the loan, the faster you pay off the house, but this comes with a higher monthly payment.

Adjustable-Rate Mortgages (ARM)

Adjustable Rate-Mortgages knows as ARMs are mortgages that have interest rates that can change over time. Generally, they start very low, but they can fluctuate with market interest rates.

FHA Loans

If you are a first-time home buyer and 20% down (the recommended amount by most lenders) is completely out of the question an FHA loan may be exactly what you need. With an FHA loan, you can become a homeowner by putting as little as 3.5% down.

VA Loans

If you served in the military a VA loan may be the perfect option for you. VA loans are known for their no down payment or PMI benefits. But you will want to make sure to compare the VA loan fees and interest rates to a conventional loan to guarantee you are getting the best deal.

RELATED:

7. How Much Do I Need For A Down Payment?

We all know that buying a home is expensive. Every little bit of money you can put down can drastically lower your monthly payment and the amount of interest you will pay.

Most lenders recommend that you put 20% down on a home. This means if you are hoping to purchase a home for $200,000 you should save $40,000 for your down payment. Keep in mind this doesn’t include other fees such as closing costs, relators fees, and inspections. I never said buying your first house was going to be cheap! Wow, it’s adding up.

8. What Is In A Mortgage Payment?

Your monthly mortgage payment is made up of 4 components. Many refer to it as PITI or principal, interest, taxes, and insurance.

At the start of your loan, most of your monthly payment goes towards interest. Over time, more and more goes towards principle, by the end of the loan, the majority is a principal payment. This process is called amortization, which I’ll cover shortly.

- Principal (what goes towards paying off your loan)

- Interest (what goes to the bank for the privilege of using their money)

- Taxes -Yep you have to pay your dues in the form of taxes, property taxes to be exact. Property taxes can add up to be a lot of money so the bank lumps them into your payment to make sure they get paid.

- Home Insurance – You also need insurance on your home. This protects you (and the bank) if your home burns down or gets damaged.

What Is Private Mortgage Insurance And Why Do I Need It?

Private Mortgage Insurance (PMI) is an additional insurance charged to people who are unable to put 20% down on their home. Unfortunately, this isn’t money that goes towards paying off your loan. In most circumstances, you can have your PMI removed once you have at least 20% equity in your home.

Private Mortgage Insurance covers the lenders rear in case you are unable to make your loan payments. Most lenders require a buffer of 20% to be put down to assure that your home will have enough equity to pay off the loan balance should your home go into foreclosure.

Many houses that go into foreclosure are often sold at a discounted price so the 20% covers the discounted price of the sale price. In simple terms, the bank wants to be sure that they can recoup the money they loaned you if the home has to be sold at a lower price than the original sales price.

How Amortization Works

Amora…. what? You may have heard of amortization before but do you really know how it works? Amortization is a method for paying off both the principle of the mortgage loan and the interest in one fixed monthly payment.

The good news for you is that you don’t have to do any of these fancy calculations because the bank will do them for you. However, it is a good idea to familiarize yourself with the process so you aren’t shocked by your first payment.

When purchasing a home you’ll owe the most interest right at the start of your mortgage, but as you pay it off, your monthly payments will shift so that you’re paying off more principal than interest.

Here is a fantastic example provided by ValuePenguin of amortization on a mortgage payment. Value penguin has some fantastic information about amortization if you’d like to learn more.

6. Look For A Real Estate Agent To Help You Buy Your First Home

A good way to find a reliable real estate agent is to get recommendations from friends and family who have bought or sold a home recently. You want to make sure the agent you choose understands you, your budget, and your wants. Characteristics you should look for when searching for an agent are experience, patience, and commitment.

Good Questions To Ask Your Real Estate Agent

• What services do you offer?

• What experience do you have in my immediate area?

• How long are homes in this neighborhood typically on the market? Be aware that several factors can impact the amount of time that a home remains on the market, including price, economy, and interest rates.

• How would you price my home? Ask about recent home sales and comparable homes that are currently on the market.

• How will you market my home?

• What is your fee? Your agent will receive a commision for helping you with the purchase of your home, however, ask if there are any other fees you will have to pay to work together.

7. It’s Time To Submit Your Offer

After looking and looking you finally found the house of your dreams and are excited to submit your offer. For some, submitting an offer can be stressful, especially if there are multiple offers being placed on the same house.

However, lucky for you the seller accepted YOUR offer. Congratulations, the next step is the Escrow process along with a home inspection and home appraisal.

Home Inspection

A home inspection is performed to provide you with information about the quality of the house. If there is something that needs to be repaired or updated you can negotiate those repairs into the asking price of the house.

Home Appraisal

A home appraisal is to verify that the value of the home is worth the loan amount you are asking for. Keep in mind a low appraisal can ruin the sale of a home because your lender will not finance the house for more than it’s worth.

8. Move-In Day!

Congratulations you are a homeowner! Today you will get the keys to your new home and you can begin moving in.

Final Thoughts

I hope you found this guide helpful in assisting you with getting to know the home buying process a bit better. Buying a home whether it be your first or not doesn’t have to be stressful or overwhelming when you know what it takes to buy your first a house.