This post may contain affiliate links, which means I may earn a small commission at no extra cost to you if you make a purchase through one of these links. Thank you for your support! Read full disclosure.

Have you found yourself asking what is compound interest and how does it work? If so, I’m happy you’re here because you are in the right place! I can’t wait to give you all the info you need to know about the importance of compound interest and how it can benefit you.

When it comes to investing, finances, and knowing what’s going on with your money it can be confusing and perhaps overwhelming. Learning the various financial terms and what they mean can take a lot of time.

One of the most important concepts about saving and investing is compound interest. Taking a moment to learn about this magical investment tool will prove to be your best friend later in life. I promise!

Table of Contents

WHAT IS COMPOUND INTEREST?

The smart and sophisticated definition is, interest that is calculated on the initial principal, which also includes all of the accumulated interest of previous periods of a deposit or loan.

The simplest way to explain compound interest is the interest you gain on interest… aka compounding.

Albert Einstein is said to have called “the power of compound interest the most powerful force in the universe.”

Don’t you think if Albert Einstein said this about compound interest it has to be a pretty awesome way to grow your money?

Let’s break this down a bit so it makes more sense

Compound interest is when you deposit money into the bank and the bank pays you interest on the amount you originally deposited each time it’s calculated.

For example if you deposit $100 and it grows at a rate of 5% interest by the end of the year you’ll have $105 because of the interest growth on your money.

You’re probably thinking to yourself “la de fricken da”. I can maybe buy myself a latte with the measly $5 I made in a year.

But wait….. Here’s where the magic starts to happen. Fast forward a year. You’ll start earning interest on your initial deposit and you’ll earn interest on the interest you just earned. MAGIC!

That means you’ll earn more than $5 next year because your account balance is now $105, even though you didn’t make any deposits, so your earnings will accelerate.

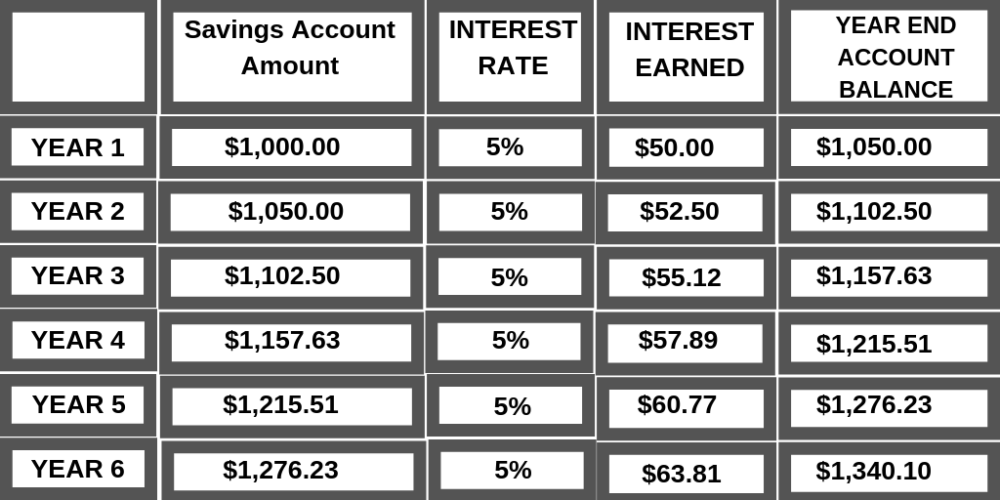

COMPOUND INTEREST EXAMPLE

WHAT IS SIMPLE INTEREST

Simple interest is just as it sounds, simple. There isn’t any fancy compounding or exponential growth involved with simple interest. Simple interest is the amount you can earn from the money you originally deposited only.

HOW TO CALCULATE SIMPLE INTEREST

To calculate the amount of simple interest you’ll earn over time use this formula:

Principal Amount x Interest Rate

After you have that number you multiply it by the number of years you’re investing your money for.

So for example:

Let’s say you invest $1,000 in a money market account with a simple interest rate of 8.5%, you’ll earn $85 in interest after one year ($1,000 x 0.085). After ten years you earn $850 ($85 x 10)

HOW TO CALCULATE COMPOUND INTEREST

To be honest calculating compound interest isn’t as straightforward as simple interest.

There’s this fancy formula you can use. But realistically I don’t see many people breaking out the formula to compare rates.

FANCY COMPOUNDING INTEREST FORMULA (FOR YOU MATH WIZARDS)

A=P(1+r/n)nt. A is the amount you have after compounding. The value P is the principal balance.

The value r is the interest rate (expressed as a decimal), n is the number of times that interest compounds per year and t is the number of years.

EXAMPLE OF COMPOUND INTEREST

Ok, for those of you who aren’t going to break out the fancy formula, let’s do this so you can see the power of compound interest.

We’re going to use the same $1,000 that we used for the simple interest example above and stick with the 8.5%.

With this account it’s going to compound once a month for over a 10 year span. At the end of 10 years your account balance will grow to $2332.65 and you’ll have earned 1332.65 in interest. Compound interest will earn you $482.65 more than simple interest!

Instead of having to do all the fancy math here’s a great site to calculate your compound interest.

It’s good to note that interest can compound frequently (daily or monthly) or infrequently (quarterly, once a year or bi-annually).

The more often your interest compounds the more money you make!

WHAT’S THE DIFFERENCE BETWEEN SIMPLE AND COMPOUND INTEREST?- (Another example)

When it comes to interest there are two ways it can be calculated:

Simple and compound … I know we mentioned this above!

Let’s say you have $1000 in a regular ole savings account with 2% simple interest. This means after the first year you’ll earn $20 interest. The next year another $20 is added to your account

The interest amount will never grow it will always be $20 because it’s only based on the principal amount.

As I mentioned earlier compound interest grows based on both the principal and interest.

So let’s pretend you have the same $1000 in an investment account that earns 2.0% compound interest. You’ll start off with earning the same $20 interest the first year which doesn’t make a different at first.

The first year you’ll have the same interest accrual as you would with the simple interest calculation.

Then get this, this is where it starts to get fun.

The second year your 2% interest is calculated on your entire new balance of $1020 not just the original $1000. So second year year you’ll have $1040 and so on.

HOW DOES COMPOUND INTEREST WORK ON CREDIT CARDS?

So we covered the magical side of compound interest and growth. The same way compound interest can be make you a lot of money it can also work against you if you have debt.

Compound interest is the number one thing that buries people who are in debt with credit cards.

The interest keeps building and building until you’re so far behind you can barely lift your head out of the sand.

Let’s break this down so you can see how easily it is to fall behind with credit card compound interest.

- Let’s say you have a revolving balance of $1,500 on your favorite credit card with an APR of 16%.

- You’re able to consistently pay the minimum amount due of $25 each month but no more.

- This situation gets difficult because you’re $25 is really only going towards your interest.

So in the big picture by only making your minimum payments each month it’s going to take you 122 months or 10.2 years to pay off your entire balance.

MAKING MONEY WITH COMPOUND INTEREST- MUTUAL FUNDS, IRAs. MONEY MARKET ACCOUNTS….

I know, I get it, saving for retirement or an emergency fund can be difficult if you’re already strapped for cash.

Especially the recommended $1,000,000 you’ll need for retirement. That’s a whole lot of cash-ola!

But having compound interest in your arsenal of kick ass tools is all you need.

Believe me this isn’t something that only 7 figure earners can achieve. Compound interest makes its possible for almost anyone to save a good amount money.

Obviously, the earlier you begin saving the quicker your money will work for you so its best to start investing early and contribute as much as you can.

That’s why all financial experts recommend you save as soon as you can.

Power Of Compound Interest And Starting Young

Here’s how compound interest works with someone who starts investing early. Let’s pretend you are just turning 18 and hear it’s a good idea to start investing your money for retirement.

- You have an after school job so you’re able to afford $50 a month towards your IRA.

- After 1 year of investing $50 a month at 7% return you’ll have $623.24 in your account.

- This means you earned $23.24 in interest.

- Now you’re in college and have scored yourself a decent job.

- Over the next 4 years you’re able to contribute $100 to your IRA at the same 7% growth rate.

By the end of these 4 years you’ll have $6,377.09, you made $953.85 in returns.

As you can see compound interest earns you more money the longer you’ve been investing.

The Power of Compounding Interest

If you have anything at all that you can throw into a compound interest account you’ll be doing yourself a favor.

Compound interest is powerful because it shows how small, consistent habits can transform your finances.

Take a moment and see if you have an extra $25 floating around that you can afford to invest.

It’s truly worth your time (literally) to have (years) working on your side to grow your money.

Starting as early as you can assures you a better savings later in life. You can watch it magically grow over the years, it’s really pretty fun!

It’s comforting to know that when facing a challenge as daunting as retirement planning, what really matters are the small, everyday choices.

I know the concepts of compound interest can be a bit mind boggling. The main take away is to take advantage of compound interest accounts as early as possible. And don’t let compound interest debts take advantage of you.

What Is Compound Interest is it now your best friend?

I really hope that you’re able to take a couple of good nuggets of info away from this post. Realizing how compound interest can either make or break you is key to your financial success.