For a comprehensive guide of what you need to do for Financial Independence Retire Early (FIRE) you have come to the right place. Looking back on my life I would have been able to make the leap to FIRE even earlier had I known what you are about to learn. Retire early without a lot of money!

This article may contain affiliate links, full disclosure here

Together we will answer the following questions for you

-

What’s the difference between financial independence and early retirement?

-

What are your goals with financial independence/retire early (FIRE)?

-

How much money do you need?

-

What are the daily routines and habits that you can start today to make this happen?

-

What are the best early retirement investment options?

Now might be a good time to check out 15 Financial Terms we all should know

This article is part of our eBook series, download below

Table of Contents

Retirement Investment

Early retirement has little to do with how much money you make, rather it’s disciplining yourself and putting your money in the right places. Retiring early is not easy and will take a lot of work. Savings and investment is only part of the puzzle. Your biggest bang for your buck is YOU. Frugality and minimalism are a must.

RELATED:

Let’s take a closer look and begin your journey towards Financial Independence Retire Early(FIRE).

What Exactly Is Financial Independence

When you think of retirement you probably envision a late 50’s to 60-year-old person. Social Security lets you start taking benefits at age 62, retirement accounts usually allow withdrawal around 60. It’s easy to accept this as the norm. But because you’re reading this I’m guessing you want something more.

Tanja Hester of Our Next Life said it best,

“Financial independence ultimately means that you can shape your life without taking money into consideration.”

For my wife and I here at Five Sense of Living, this doesn’t mean never making a dime again, but rather never letting work or finances dictate where, how, or what we do. It’s all about flexibility. It’s a loose definition of “retire” and one that you will be able to define for yourself.

I would encourage you to focus more on the financial independence component than early retirement. The timing of “EARLY retirement” is not as important as the financial independence component.

Strive for the independence and the “early” will come naturally

What Are Your FIRE Goals

Everyone will have a slightly different interpretation of their own personal FIRE. Maybe for you, it’s quitting the corporate rat race and doing something that will pay way less but that you truly enjoy and believe in.

That right there is freedom and independence. For others it might be the more traditional, sit on a beach all day, retirement.

The point is that YOU need to figure out what your own FIRE is. I believe accomplishing FIRE without having a purpose might not be a good thing. Shooting for FIRE just because you hate your job may land you in a place without purpose.

Instead focus on what would make you happy. Maybe it’s just that lower paying job that you actually enjoy.

So ask yourself, what do I want with my new found FIRE?

How Much Money Do You Need?

When going after FIRE it’s important to define a savings target for your plan. This goes back to what FIRE means for you. This number is personal and depends on your goals, everyone will be different. Some can live off $20,000 per year while others need more.

[click_to_tweet tweet=”How much $ do you need for your FIRE per year?” quote=”How much $ do you need for your FIRE per year?”]

Create a budget. What! You don’t have one!

Ahh yes the B-word

It’s time to start tracking your spending and create a budget. This is crucial for you to fully understand where your money is going. Without this, you will not be able to find an accurate retirement number for yourself. Your annual expenses now are usually not what you will need for retirement. Student loans, cars, and even a home may be paid off.

By tracking your budget and your spending you can easily subtract these costs that may not be applicable based on your FIRE goals.

There’s more to creating an accurate budget then writing down what you can remember on a cocktail napkin. Creating a budget will get you started the right way.

What do we use for budgeting and to track spending? Personal Capital is our favorite and even the free version will have most everything you need. We’ve seen that just tracking your spending without doing anything else helps people to save money.

Finding Your FIRE Number

Now that you have a budget and a general idea of what your FIRE plan is, it’s time to look at the big numbers.

A simple approach to get you in the ballpark is the 4% Percent Rule. I’ve written a detailed description of it here that I would encourage you to read.

Total Savings = How Much Money You Need Each Year X 25

Example: I’m going to need $3,000 per month. That’s $36,000 per year. To find my savings total I then multiply by 25 and we get $900,000.

This allows you to withdraw 4%($3,000) plus inflation every year for a very long time. Just how long? Read the 4% article.

Remember this does not take into account Social Security when you hit your 60s or any other retirement money you may have lined up through work. All of that needs to be taken into account as well.

With me for example, I will have Social Security that kicks in at 62 and a $1,800 per month work retirement plan that starts at age 54. I also plan to have some revenue during my ‘retirement’ so my number is much less than $900,000.

This number is difficult to define and may in fact change as things change in your life. Be flexible but don’t delay starting the process. Later in this article, I will talk about some lifestyle habits and routines that may get that number even lower. This is an important step and should have been started yesterday.

Excessive spending will kill early retirement quicker than anything. For now, let’s just work on getting a ballpark number.

[click_to_tweet tweet=”The EXACT steps we took to achieve Financial Independence and Early Retirement” quote=”The EXACT steps we took to achieve Financial Independence and Early Retirement”]

Frugality And The Habits Of FIRE

I’ll say it again, if you’re not tracking your spending and keeping to a budget you must start now. The beauty of Personal Capital is how it tracks and categorizes all your spending for you. If you prefer paper,

If you cranked out your 4% number from above you may be thinking,

How will I ever save that much?

You likely don’t have control over how much money you make at work. But you DO have control over your spending and what that number needs to be. All of your successful 30-year-old early FIRE folks will tell you that frugality was a big part of their success.

[click_to_tweet tweet=”You likely don’t have control over how much money you make but you do have control over your spending” quote=”You likely don’t have control over how much money you make but you do have control over your spending”]

Two Parts To Financial Independence Retire Early | FIRE

On one side you have the investment component where you will save money and appropriately invest that for later use.

On the other side is you and your lifestyle. A big part of FIRE is learning to discipline yourself and keep costs down. Mr. Money Mustache, a frugality master achieved early retirement by age 30 and lives on $24,000 per year. That required a total savings of only $600,000. Here’s an interview with Pete from Mr. Money Mustache.

Be sure to read,

- Making Minimalist Decisions That Will Save You Money

- 13 Things You Are Wasting Your Money on

- 14 Easy Ways to Save Money When Going Out

These articles will give you practical ways to save money. This is perhaps the most important part of FIRE, coming to terms with how you can lessen your financial footprint.

Learning to live on less is not about sacrifice. It doesn’t have to be ‘not fun.’ Instead, think of it as prioritizing and making your fun more efficient. Best bang for your buck.

Paula Pant at Afford Anything said it best,

Frugality is a value, not a tactic

Make your financial education a priority. Educate, educate, educate!

Investment Tax Relief | Early Retirement

The best time to start investing was YESTERDAY. So don’t wait another minute. Well actually finish this article and then get to it.

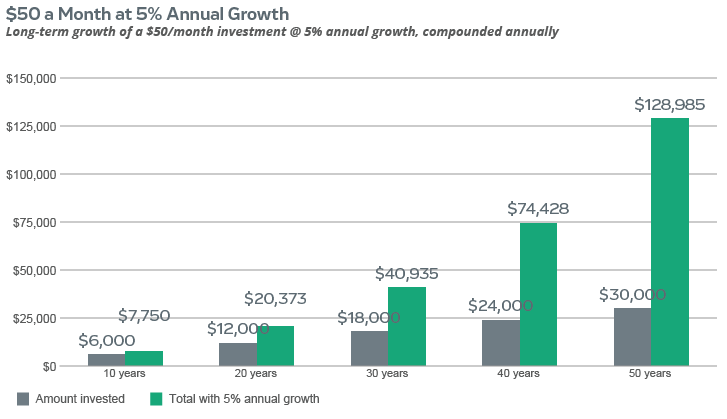

The biggest muscle you have in terms of savings is the power of compounding and using time to your advantage.

You can see how just $50 a month can have huge returns over time. You need to capitalize on this for your success in FIRE.

Pre-Tax Investments

Pre-tax investments, such as 401(k)s and traditional IRAs, are also described as tax-deferred. They allow you to postpone paying taxes on the amount you contribute and the earnings as long as the money stays in the account. When it’s time to withdraw funds at the defined age, you’ll pay taxes on them.

Benefits:

- Earnings grow tax-deferred and thus have the potential to grow faster than a taxable investment.

- At the time of withdrawal, you may pay fewer taxes since your taxable income will likely be lower.

After-Tax Investments

A Roth IRA is similar to a traditional IRA but you are taxed in the beginning rather than at the end when you withdraw.

- A Roth has a unique advantage for early retirement in that you can withdraw, penalty-free, any money that you put into it. Any money that you’ve earned on the interest will be penalized if taken out early.

You may be asking, How do I get my money out of these accounts early without penalty?

Great question and it’s called the ROTH IRA conversion ladder, one that we go into great detail on here, Roth Vs. Traditional IRA for Early Retirement. Traditional IRA to ROTH conversion is one of THE most important pieces to our FIRE. In that article, we also discuss another option, Rule 72t or SEPP. While it’s not our favorite it should be considered.

Let’s not forget about the Health Savings Accounts (HSAs)

A very powerful tool for FIRE that is well covered in this article, a must read! Why an HSA might be the ultimate early retirement account.

Take Advantage Of Free Money

Find out what plans are available to you through work. Take advantage of those pre-tax company plans such as flexible spending accounts. Obviously, any sort of company match investment option should be maxed out first. Then work on maxing out the IRA of your choice as well as an HSA if it’s available to you.

Don’t worry if you don’t have the money to max these accounts out every year. A little is a TON better than none. But do make these accounts a priority in your budget. I always recommend the Traditional IRA to Roth ladder and HSA for the early withdrawal option.

Because of their tax advantage, these accounts are getting a roughly 33% boost in your money compared to other options. For that reason, these must be a priority and started as early as possible.

[click_to_tweet tweet=”You don’t need to be rich to retire early!” quote=”You don’t need to be rich to retire early!”]

Beginners Guide To Investing

What Is A Robo-Advisor?

A Robo-advisor is an automated portfolio manager. It’s a computer algorithm with a definable set of rules that make appropriate investment decisions based on your specific needs. With the recent proliferation of robo-advisors, it’s almost ‘old school’ to have a human manage your investment.

A robo-advisor is a good choice for those that prefer a hands-off approach to investing. I prefer them over a human managing my investment for several reasons.

- A human managing your account can be a real gamble. You just don’t know if they give a crap. Sure they all sound great on the phone but are they really putting in the hours to maximize your investment. Some are great, others are not. Robo-advisors take that human variability out of the picture. I’m not saying the robots are better but at least less variable.

- Robo-advisors cost significantly less. Computers can process a lot of data in the fraction of time it takes a person to. A lot of the data a person would analyze is exactly what a robo-advisor looks at but in a split second.

- Automatic portfolio rebalancing. A smart practice where your original stock/bond ratio is maintained automatically.

- Tax-loss harvesting, an effective tax management strategy.

- These tactics take time and because they can be done automatically through a robo-advisor you win with better results.

Robo-advisors are not the choice for people with complex investments or those that prefer to have a lot of control. Learning how to invest in stocks on your own can be really rewarding and fun. I encourage people to do both and find what works best for you.

Below are our 3 favorite investment platforms. Swell and Betterment offer robo-advisor options while Vanguard offers a human touch.

Swell Investing

Swell Investing aspires to give enhanced investment options to people who care about where their money goes.

At Swell, we practice Impact Investing. We invest your money in companies solving the world’s biggest problems-Swell Investing

How Swell Chooses Companies

Thousands of companies are evaluated and diversified and solution-focused portfolios are created. Below summarizes their philosophy of company selection.

- Top Down – Big problems equal big opportunities – identifying these problems and the firms addressing these high impact themes can make for strong investments.

- Assess impact – Companies included derive revenue from environmental or social impact as a part of their business.

- Bottom Up – Each companies financial health, valuation, and liquidity are analyzed. Combining this data, each company is assessed as an individual, and as a constituent, in each portfolio.

In addition, every company Swell chooses must have revenues in alignment with at least 1 of the 17 United Nations Sustainable Development Goals. These goals are designed to help governments and stakeholders from around the globe tackle climate change, poverty, and inequalities.

Swell’s Portfolios

- Green Tech

- Clean Water

- Zero Waste

- Renewable Energy

- Disease Eradication

- Healthy Living

Here are some portfolio details as well as results from Swell.

Fees

Swell has a 0.75% annual fee and a $50 minimum account value. This makes for a great starter investment account if you don’t have a lot of money to throw at it.

A $500 investment will run you about $3.75 per year. While this fee is a touch more expensive than other options we just can’t get over how cool of a company Swell is. It just feels good putting your money towards making this world a better place. A great user interface that works well even on mobile devices. Even just putting a portion of your money in Swell will leave you feeling good about your investment.

Betterment Investing

Betterment is a clear leader in the robo-advisor race with over 300,000 clients and $11 billion in assets under management. It also has low minimum account balances and has one of the lowest annual fees.

Truly a great option. Their new account setup is intuitive and easy. Through a series of questions Betterment will build you a portfolio based on your timeline and needs.

You are allowed to fine tune your stocks vs bonds allocation but any further specifics, for the most part, you are not in control of. This is a perfect option for those just starting out and who are new to investing. A mix of 30% Swell and 70% Betterment would be a great place to start.

All of these options I have listed thus far are more of the “set and forget” method of investing. If you want to have complete control over individual stocks/bonds then there are other options. And to be honest I would look elsewhere as that is not our expertise. While we do a little portfolio management ourselves the bulk of our investments are professionally managed.

Vanguard Investing

Without a doubt one of the most powerful and popular investment platforms available. For those that want complete control or the set and forget types, Vanguard has something for everyone. While Vanguard has the most options as well as competitive rates, its minimums can be rather high if you are just starting out. There are, however, some great ways to get started with Vanguard without the worry of high minimums.

Vanguard ETFs

ETFs are exchange-traded funds. They are a collection of stock and bonds in a single fund. They may be made up of tens, hundreds, or even thousands of different stocks or bonds.

When compared to stocks and bonds, ETFs are less risky and typically more stable because of their large diversification.

ETFs, when compared to mutual funds, have lower investment minimums and costs, making them a better beginner option.

ETFs are a great place to start and once your account balance grows you can then branch into other areas of investment.

Vanguard would be my first choice for IRAs or 401(k)s. I would then look at Vanguard ETF’s/Betterment and Swell for the remainder of your investment.

Final Thoughts

Investing is complicated but with these options, you can get your investment started right now and feel good about your choice. As your portfolio develops and your education increase you can always take more control and practice different investment strategies.

I wish someone had told me to do this in my 20’s. Even just $50 bucks a month towards one of these would have taken years off my retirement.

Another slick way to sneak money away for investing is the Acorns app. It rounds up your purchases and puts them toward an investment plan of your choice. They even offer IRAs now as well. You can read my full review of the Acorns app here. While I do use this app and enjoy it, I don’t think it should be your primary retirement source. I would also recommend Vanguard over Acorns for your IRA.

I Hope You Enjoyed These Retirement Planning Guideline

- Start now! Even $50 a month towards this makes a huge difference.

- Identify you FIRE goals and establish a timeline

- Find the magic $ number but don’t forget all that you learned about being frugal

- Keep educating yourself just like you’re doing now

- Get started with your tax-deferred options through work or an IRA. Don’t wait another day. I don’t care if you just graduated from high school. Find some money and get it started.

- Through budget tracking and frugality continue to save and invest your money.

Once you have all these pieces in place, you will have accomplished something that very few people do. This is a wonderful start and the light at the end of the tunnel will be evident and be cheering you on.

It always seems impossible until it’s done – Nelson Mandela