Have you heard the term home equity or home equity loan before but are unsure what it all means. I was too at one point! It wasn’t until we were looking into doing a garage expansion at our old house that I learned the benefits of a home equity loan. After doing some research I realized that a home equity loan was the perfect loan to help us pay for our home improvement project.

Table of Contents

What Is Home Equity?

Home equity is the portion of the property you truly “own.” It can increase over time if your property value increases or mortgage loan balance is paid down.

Let’s use an example to better understand home equity. Let’s say you purchase a home for $200,000 and put $40,000 cash down. While you do own the home you actually only “own” $40,000 of it.

If you decided to sell that home tomorrow and it appraised at $200,000 you would have $40,000 in equity from your cash down-payment. You won’t have your homes full appraised value in equity until your home is completely paid off.

You can calculate your home equity by subtracting your loan balance from the value of your home. If it’s negative that’s because your home is worth less than you owe on it.

Building Home Equity

It’s good practice to think of your mortgage payment as a

1. Paying Off Home Loan

Regular Monthly Payments

When you make a mortgage payment part of your money goes toward interest and part goes toward your principal loan amount.

Basically, as you start paying on a new mortgage the majority of your payment goes toward interest and not the principle. With each

An amortization table will show you just how this works and I highly recommend you take a look at this. It really puts things into perspective. And

RELATED:

- How Much House Can I Afford And Not Become Poor

- What Is A Mortgage? Everything Beginners Need To Know

- Buying Your First Home? 8 Things You Need To Know

So how can you build equity faster and avoid paying interest?

Shorter Term Loans

A 15-year loan will pay down your debt quicker and with less interest waste than a 30 year loan. Short-term loans come with better interest rates and because you are paying over less years you will significantly reduce the money you waste on interest.

Making Extra Mortgage Payments

Making extra payments have a huge impact and can shave years of payments off of a 30-year loan. Just be sure that your lender puts those extra payments towards the loan principle and not towards interest.

When buying a new home I recommend budgeting for your mortgage payment plus 25% a month. Take your mortgage and multiply by 1.25. This will allow you to make extra payments and build your equity more quickly all while lowering the amount you pay in interest.

In addition that extra payment is a nice buffer should a financial hardship come about. If finances get tough you can always just stop making that extra payment.

RELATED:

2. Property Value Increases

The second way to increase home equity is for your home to become more valuable, either because the market has improved or perhaps you’ve done some upgrades to the home.

While updating a kitchen or bathroom will likely increase your home’s equity this must be balanced with the upfront costs of the remodel itself. It’s important to research and pick home improvements that have a high return on investment.

One of the best ways to keep your home’s equity improving is through routine home maintenance. A home that is in disrepair will not appraise well and can lead to more severe problems that can cost you more in the long run.

Let’s look at another exapmple. After 10 years your home is valued at $350,000. The original purchase price was $300,000 and your current loan balance is $150,000.

You have gained $50,000 in equity from your home value increasing in addition to the $150,000 in equity you have from making payments, for a grand total of $200,000.

What Is Home Equity Good For?

So now that you have an idea of what home equity is let’s discuss why it matters to you.

Home equity is an asset, has many uses and is part of your net worth. If you’ve run the calculation above and you have $200,000 in home equity that is a big chunk of change you can do things with.

If you were to sell your house that equity would be paid out to you in cash or you could roll it into another home purchase.

What Is A Home Equity Loan?

A home equity loan is when you take all or a portion of your home equity out in the form of a loan also known as a second mortgage. You can use the money for basically anything such as home improvements or paying off other debt.

With their low-interest rates and easy qualification, home equity loans can be quite tempting. But before you take a draw on your home’s equity be sure you understand the benefits and risks.

Let’s not forget if you have a hardship and can’t make payments your home is the collateral and the bank could potentially take your home and sell it to recover its investment.

Home equity loans offer up two basic options, lump-sum and Home Equity Line of Credit (HELOC).

Home Equity Loan Lump-Sum

With a lump-sum loan you get all the money upfront. Perhaps what you would want for something like a large remodel or paying off high-interest debt.

Your repayment terms will usually vary between 5-15 years. You will have to pay interest but in general these will be one of lowest interest rates available. Interest rates are usually fixed which makes long-term planning and budgeting easier.

Home Equity Line Of Credit (HELOC)

Similar to a credit card this type of home equity loan allows you to pull funds as necessary. If and when you do borrow funds you will be charged interest until that amount is paid off.

HELOC’s are useful for situations where you need long-term withdrawal options and not a large lump-sum.

It’s important to evaluate a simple unsecured loan such as credit cards alongside a HELOC. The one advantage credit cards or unsecured loans have is that they have no closing costs. The closing costs of home equity loans may not be the best move depending on how much you borrow and for how long.

Buying Your Next Home

One of the most common uses of home equity is to put that equity towards the purchase of another home. Whatever equity you have in your current home when sold can be used towards your new home.

Reverse Mortgage

Another option for those at retirement age is to take monthly or lump sum payments of their equity. These reverse mortgages are complicated so it’s important to understand them well and be properly informed.

But in the right

How To Get A Home Equity Loan

Just like any loan it’s a good idea to shop around comparing fees and interest rates. What you get will depend largely on your credit score.

The process may take several weeks as some lenders may require a home appraisal.

Lenders will be looking for at least 15 percent equity in your home and a debt to income rate no more than 45%. Credit scores can be as low as 600 but don’t expect great rates.

In general lenders will only let you borrow up to 80% of what the home is worth. This number may go up or down depending on credit.

Check Your Credit Score

Before you start shopping around for lenders for your home equity loan check your credit report at AnnualCreditReport.com to see where you stand. You may be able to get approved if you have a low score but you will receive much better interest rates if you have a good score.

Even if you aren’t worried about your credit score I recommend checking it anyway. There could be an error on your report that could be quickly resolved by disputing it through a company like Credit Sesame.

Improving your credit score isn’t impossible, but it takes a bit of time and effort on your part. If you have a poor score don’t be surprised if your lender asks you questions about items on your report. Your lender is ultimately trying to help you get the best loan possible so every little bit of information you can provide helps them to understand your creditworthiness.

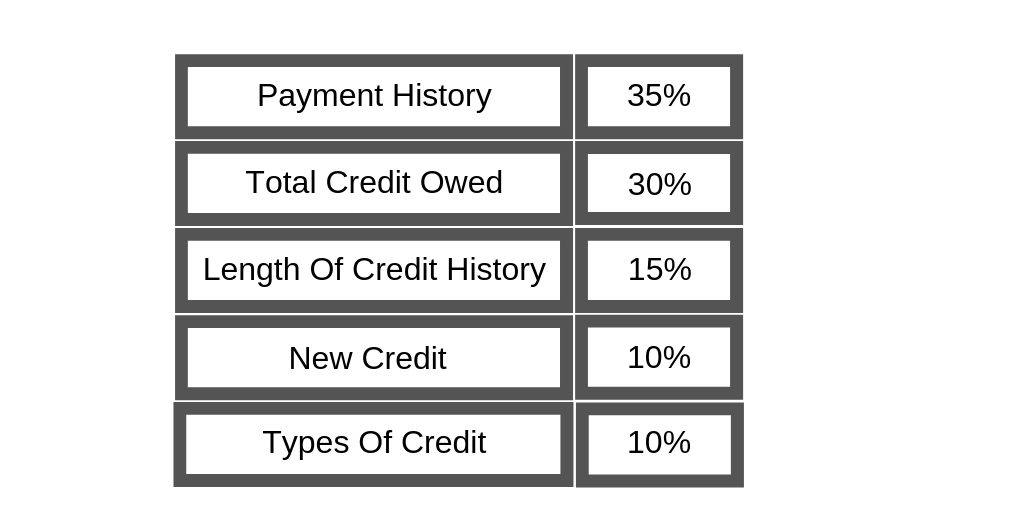

Here are the factors that influence your credit score:

RELATED:

- A Beginners Guide To Understanding And Improving Your Credit

- Credit Card Disputes- Everything You Need To Know To Come Out A Winner

- 5 Smart Ways To Improve Your Credit Quickly

Final Thoughts

I’m curious, have you ever taken out a home equity loan? If so, did you have a good experience? Are you a person who has good credit or less than desirable credit? Did your credit impact your ability to take out HELOC?

Don’t forget to share and pin for later! While you’re there, I’d love for you to follow me on Pinterest