This post may contain affiliate links, which means I may earn a small commission at no extra cost to you if you make a purchase through one of these links. Thank you for your support! Read full disclosure.

There’s something very special about owning your own home. It’s a tremendous accomplishment and one you should be proud of. Along with a home comes the mortgage. Your mortgage is likely not at the center of celebrations. It is however at the core of owning a home.

The first step to a successful home purchase is understanding your mortgage. Here are 5 mortgage calculators that will get you off to a good start. You will see that the number one pick is a mortgage calculator with extra payments, extra payments allow you to pay off your mortgage quickly. Hopefully, these will motivate you to save BIG bucks.

Related

Table of Contents

The mortgage calculator recipe

There are a lot components that go into an accurate mortgage calculation. Let’s go over these so we are clear on what they are so we can pick the best calculator.

10 components needed to accurately calculate your mortgage

1. Home price

The dollar amount you expect to pay for a home.

Related

2. Down payment

The down payment is money you give to the home’s seller. A 20% down payment typically lets you avoid mortgage insurance. Anything under 20% you will be paying PMI (private mortgage insurance, see below).

3. Mortgage Amount

If you’re getting a mortgage to buy a new home, you can find this number by subtracting your down payment from the home’s price. If you’re refinancing, this number will be the outstanding balance on your mortgage.

4. Mortgage Term (Years)

This is the length of the mortgage you’re considering. For example, if you’re buying new, you may choose a mortgage loan that lasts 30 years. On the other hand, a homeowner who is refinancing may opt for a loan that lasts 15 years.

5. Interest Rate

This is the interest rate of your loan. This will depend on things like your credit score and the length of your mortgage.

6. Mortgage Start Date

Select the month, day and year when your mortgage payments will start.

7. PMI

Private Mortgage Insurance (PMI) is calculated only if down payment is less than 20% of the property value and stops as soon as the outstanding principal amount (balance) is less than or equal to 80% of the home value. PMI is estimated at following rates: 95.01-100% LTV = 1.03% , 90.01-95% LTV = 0.875%, 85.01-90% LTV = 0.625%, 80.01-85% LTV = 0.375%. The actual PMI is based on your loan-to-value (LTV), credit score and debt-to-income (DTI) ratio.

8. Accelerated payoff

Bi-weekly payments (aka ‘Accelerated Bi-weekly’, ‘True Bi-weekly’ or ‘Bi-weekly applied bi-weekly’) help reduce your total interest cost and accelerate mortgage payoff.

9. Homeowners insurance

This is simply the cost of your home’s insurance policy. These are required and usually billed every 6 months. Most calculators will ask for the amount you pay monthly.

10. HOA

Homeowners association dues are often annual and most calculators will ask for the amount you pay monthly.

What Makes a Good Mortgage Calculator

A good mortgage calculator is one that allows you to see just what happens to your money over say, a 30-year term. It’s important that the calculator offers bi-weekly payment options, I will show you why this is important here in a bit.

Many mortgage calculators don’t offer you HOA, PMI, and homeowners insurance fields, this is a problem and give you false results.

I started out trying to find 5 good mortgage calculators and I couldn’t. There is really only one I recommend. I will show you the additional 4 but they are all lacking important components.

5 Mortgage Calculators From Best To So-So

I went through the first 20 results on Google for Mortgage Calculators. I was hoping to come up with 5 good options instead, I only found 1. Google had it right, my number one is also ranked #1 on Google and is hands-down the best mortgage calculator.

1. U.S. Mortgage Calculator

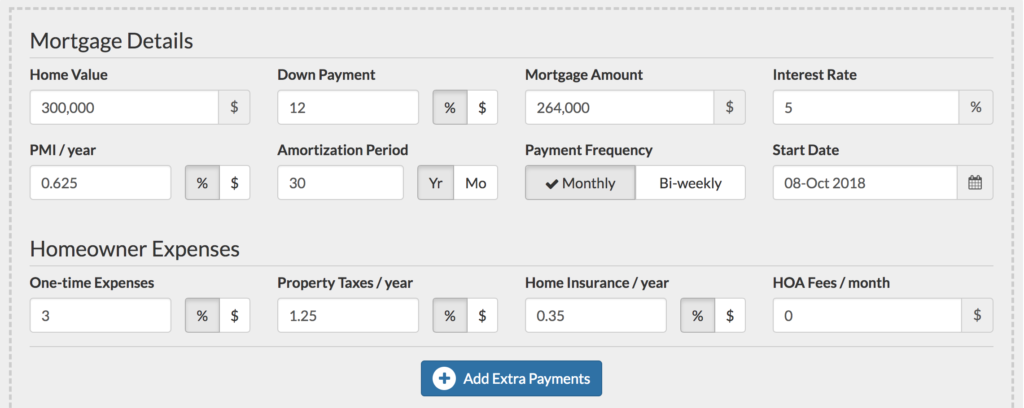

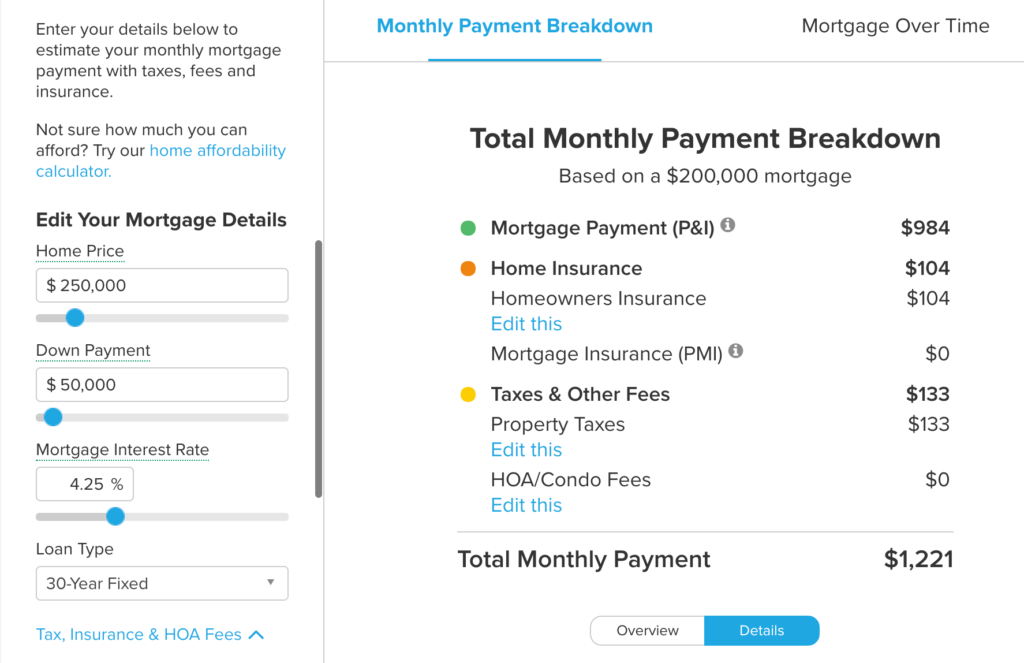

The U.S. Mortgage Calculator is a favorite for several reasons.

- It has all the necessary fields such as HOA, PMI, Bi-weekly payments, and insurance

- It offers a one-time expense box to cover any unlisted expenses

- It’s a clean calculator without a ton of adds. The Bi-weekly field is a must, I’ll explain later.

- It has month by month cost breakdowns for the entire duration of the loan.

- There’s a reason this is #1 in Google search.

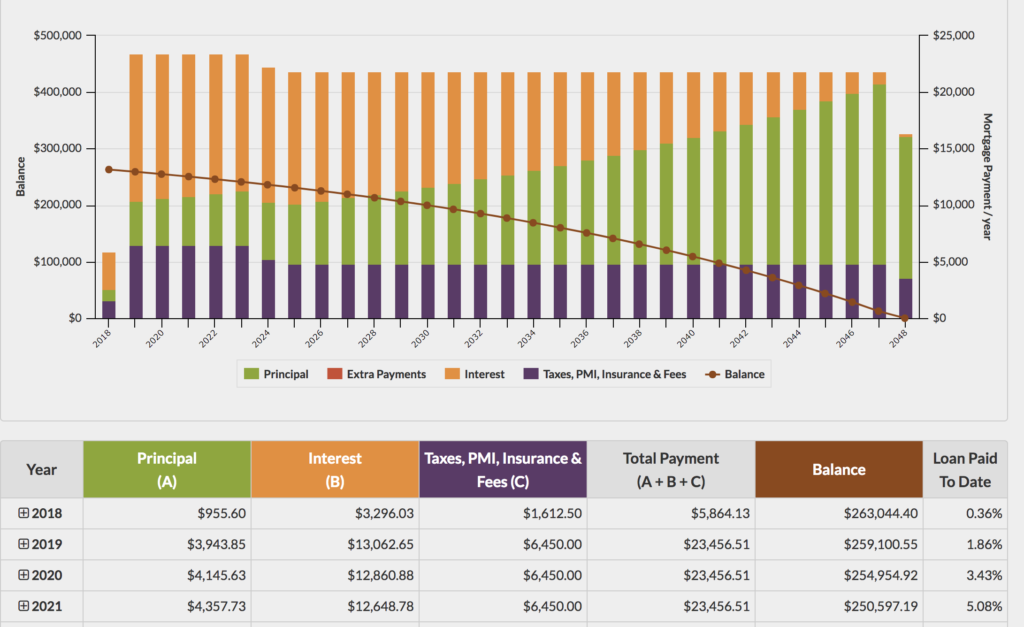

Here we have some nice graphics and the month by month spreadsheet.

Here you can see the Bi-weekly payment benefit and below that is an entire page full of instructions on how to use the calculator. This is my favorite Mortgage Calculator. Look at the savings with a Bi-weekly payment, don’t worry I’m going to cover that in a bit.

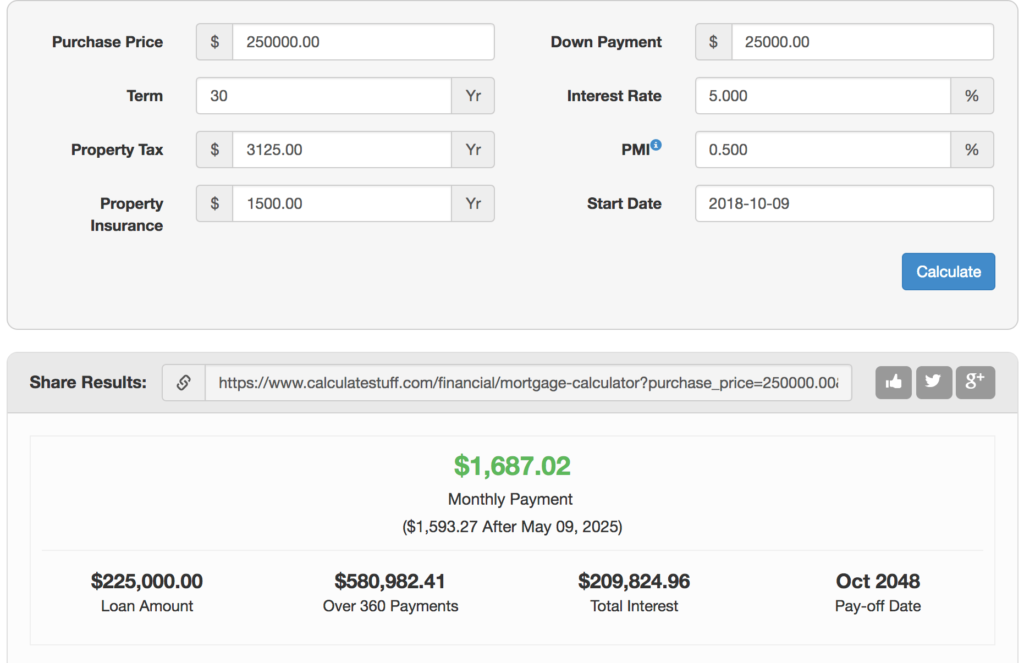

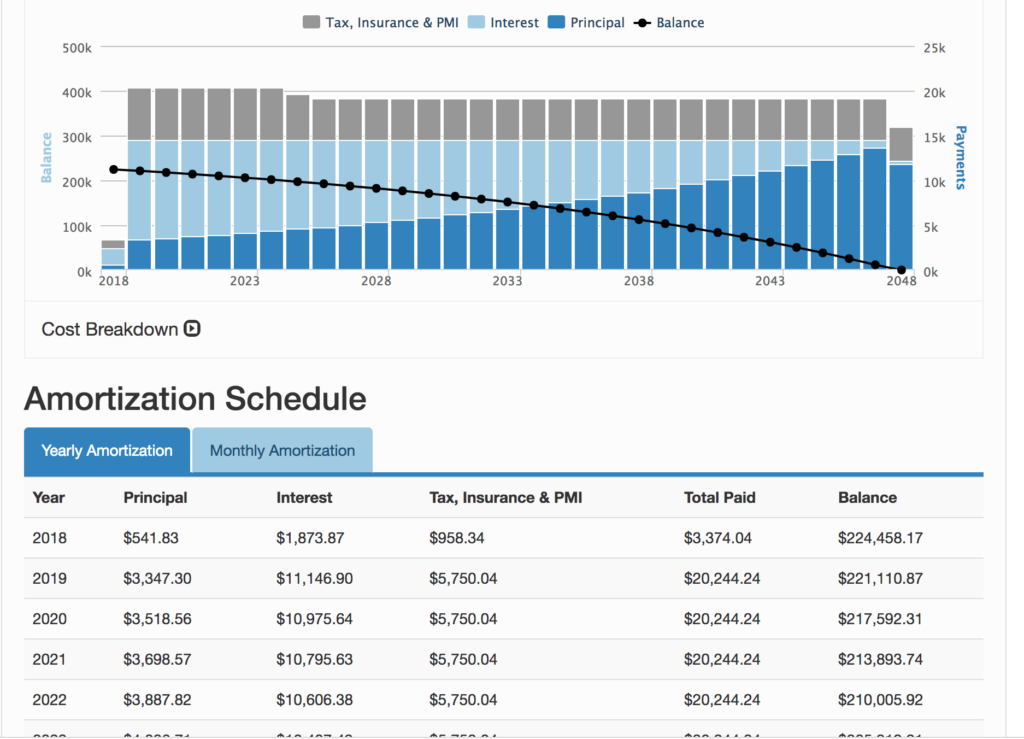

2. Calculate Stuff Mortgage Calculator

It’s been harder than I thought to find Mortgage Calculators that have all the components you need. Calculate Stuff is another okay option but it does lack the Bi-weekly option so it is inferior to my number one choice.

It’s a clean layout without a ton of adds. It offers month by month detail but lacks any sort of instructions or definitions.

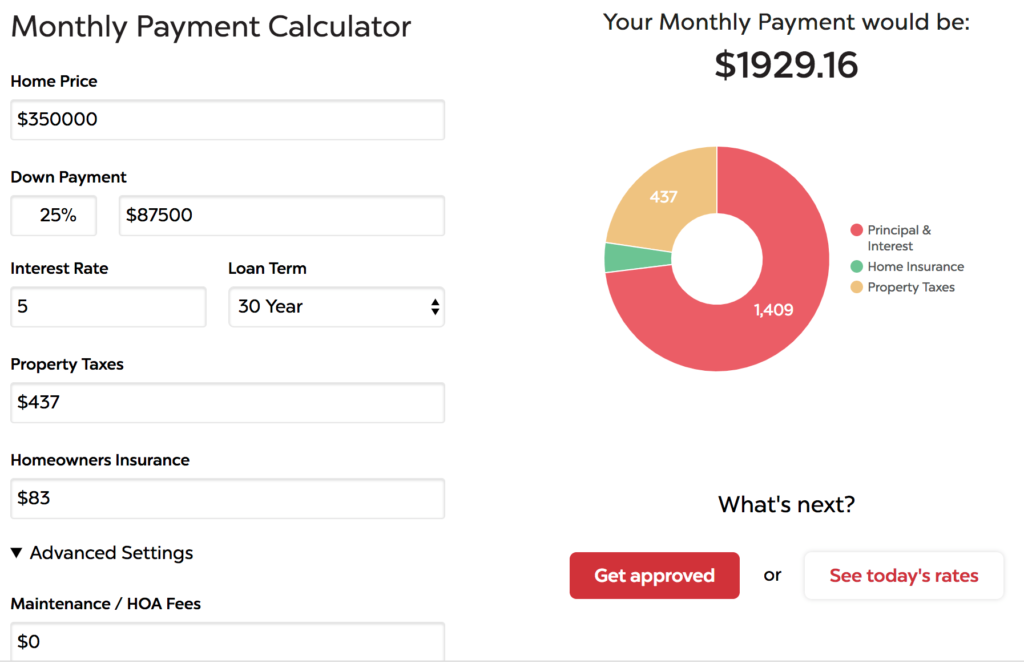

3. Guaranteed Rate Mortgage Calculator

Guaranteed Rate is another so-so option. The problem with many of these calculators is that they are just extensions of the loan company so all they are really trying to do is get you to buy a loan from them. Their focus is not on the actual calculator.

As you can see this one is very unremarkable. It lacks some important fields, has limited graphics, and no month by month breakdown or Bi-weekly options. It does have instructions but as you can see it just pushes you towards buying their loan.

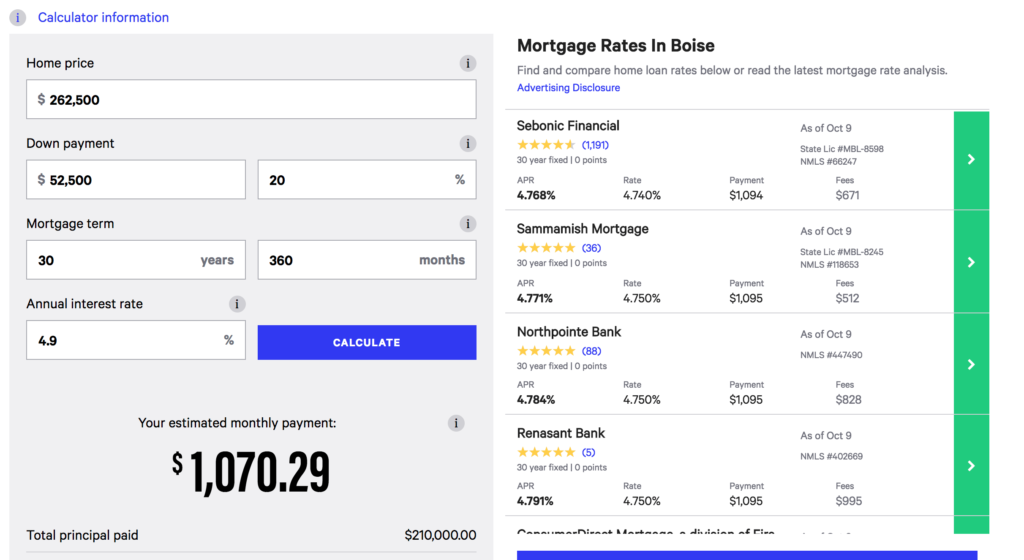

4. Bankrate Mortgage Calculator

The Bankrate calculator is also not complete in my opinion. The only thing it has going for it are it’s instructions as they are clearly indicated by the “?” on each field box. But again it lacks many important fields and only provides the most basic information.

As you can see it is cluttered with ads, no graphics, and only the basic information.

5. Smart Asset Mortgage Calculator

The Smart Asset Calculator has all the fields except for Bi-weekly. It also lacks month by month details but other than that does a decent job.

In Review

I hope by now it’s obvious why Google and myself agree that U.S. Mortgage Calculator is the best. I was surprised that I couldn’t find anything else that compared to this calculator. Now that we have the best calculator let’s talk about some important information this calculator can show us that others can’t.

Money Saving Mortgage Tips

Let’s open up U.S. Mortgage Calculator once again and I will walk you through some really cool features that can save you some serious money.

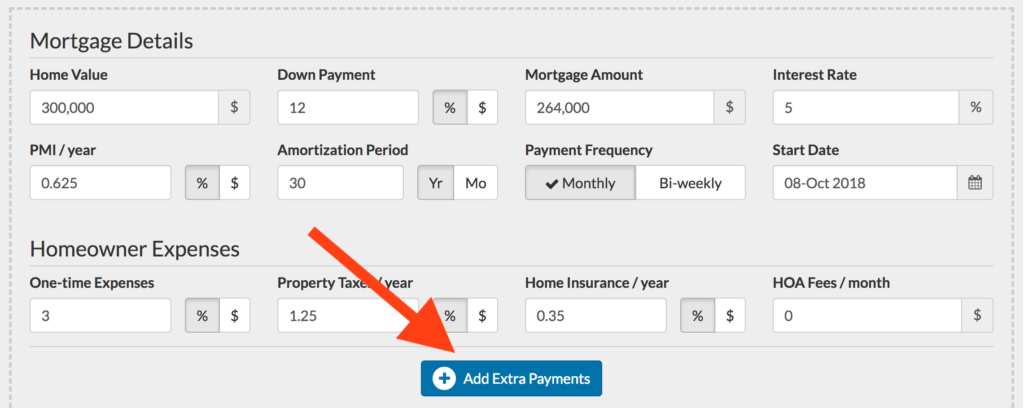

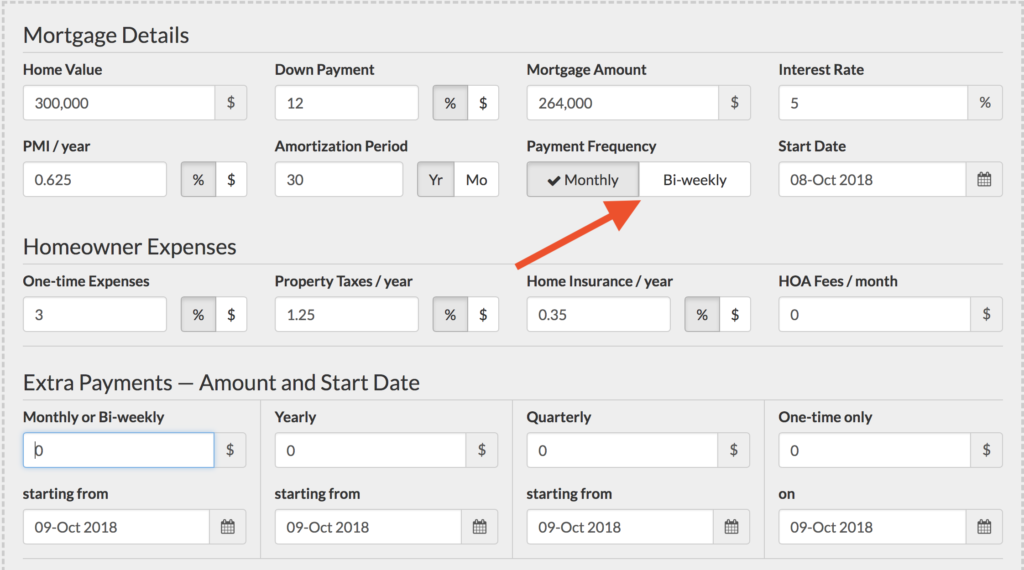

Here’s the opening screen and you see the arrow pointing to “Add extra payments.” Let’s click on that.

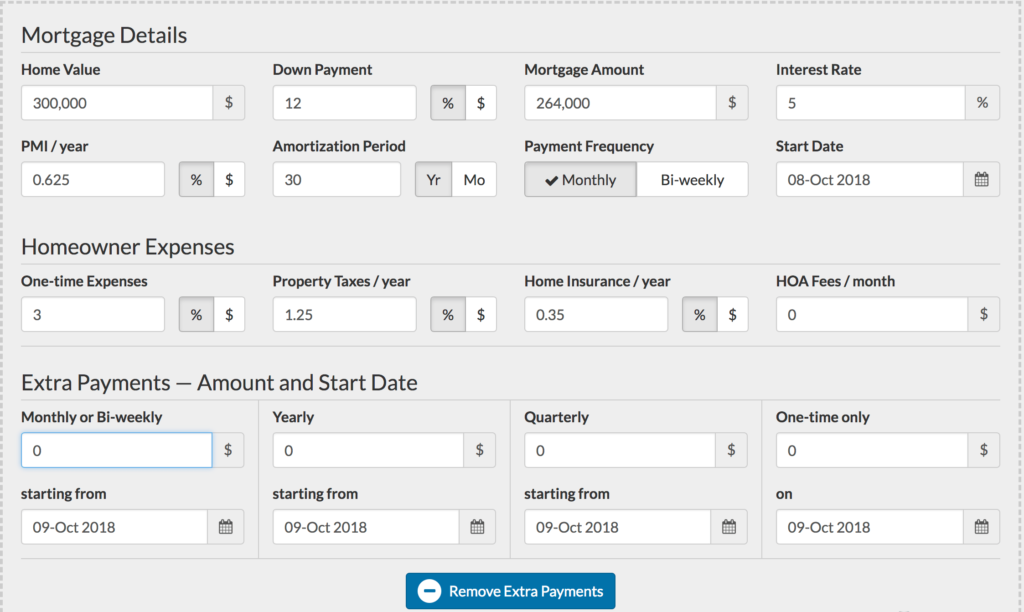

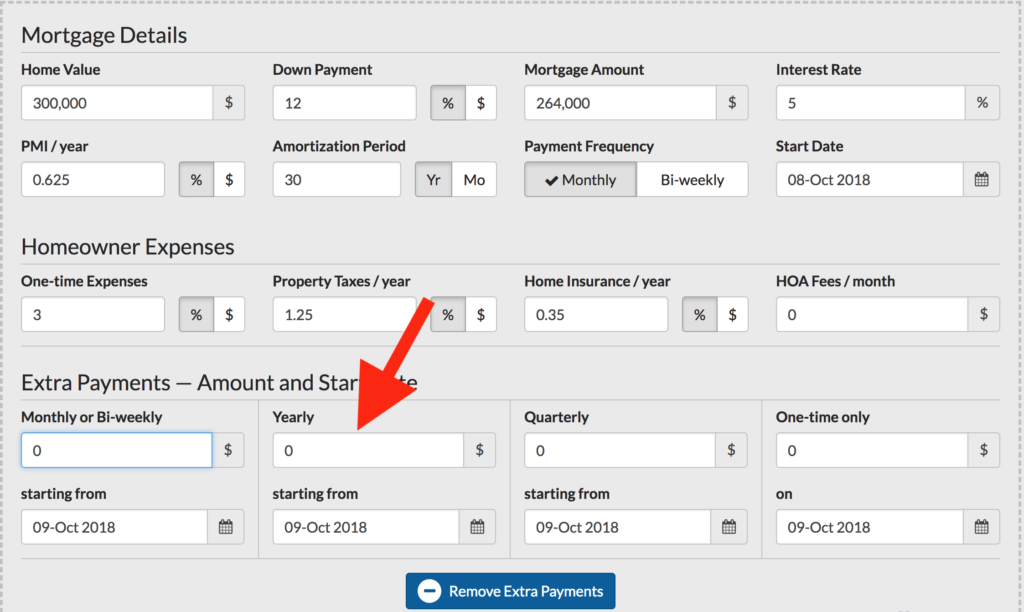

That opens up a goldmine of additional fields that I couldn’t find in other mortgage calculators. These fields are powerful and can help you to understand some money-saving mortgage tips. If there’s one thing I want you to take home today it’s this. Bi-weekly payments and an occasional extra payments will save you BIG money in the long run. Let’s look at an example.

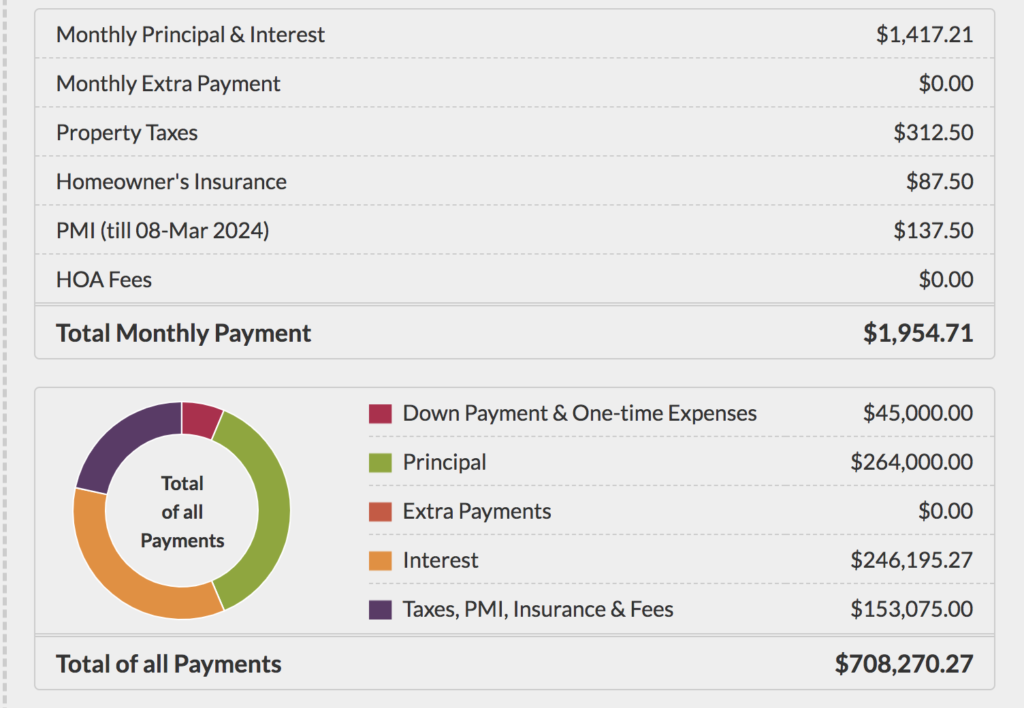

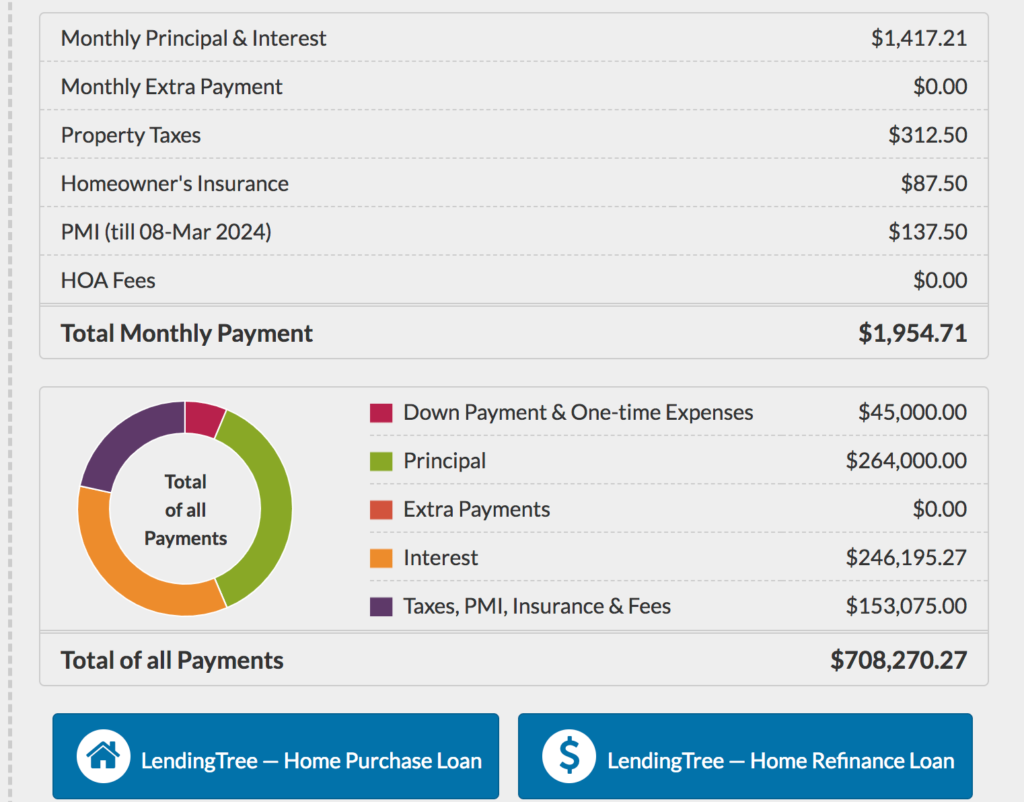

Below is the cost breakdown paying on a monthly basis.

Over the life of the loan, you will end up paying $708,270 for that $300,000 home. Crazy huh!

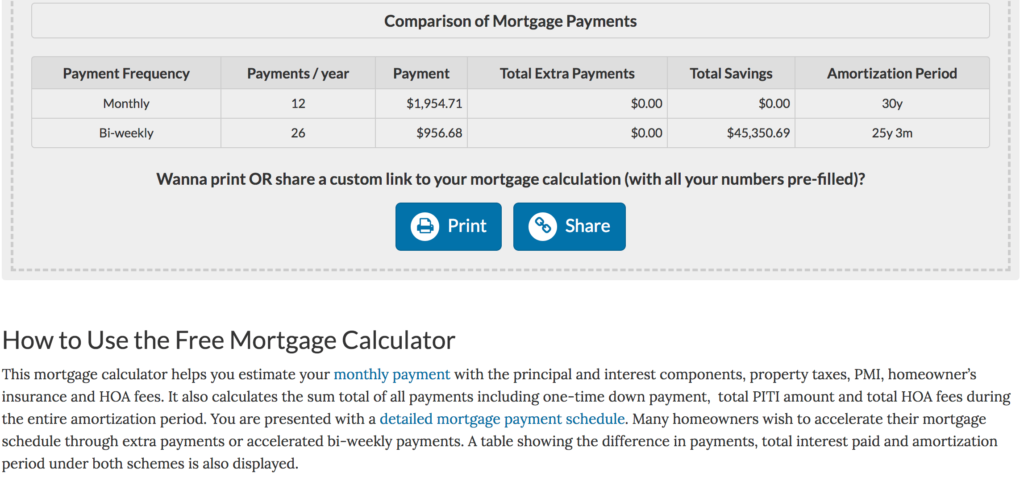

Now let’s look at what happens if you pay the same amount of money each month but on a Bi-weekly payment schedule. Again it’s the same monthly amount but just cut in half and paid twice a month.

To do this we need to select the Bi-weekly tab here,

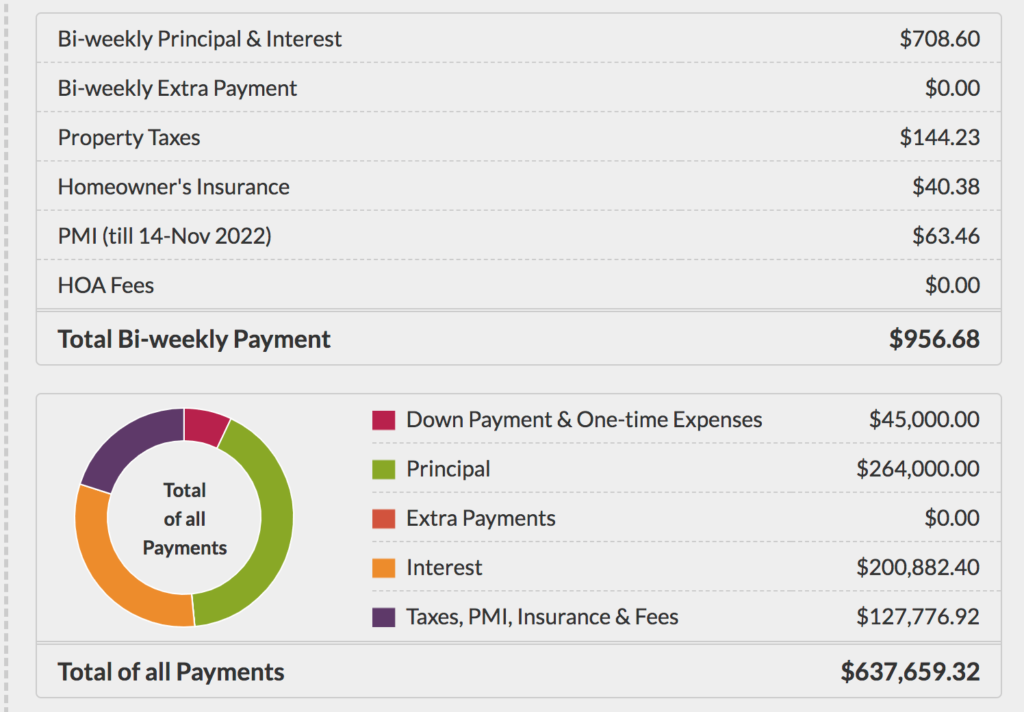

Below are the results of paying the SAME amount of money each month, but instead of one lump sum each month you pay twice per month.

Our total cost for the $300,000 home is now $637,659. That’s over a $70,000 savings!

The drop-down “Extra payments” box offers additional ways you can forecast out huge savings. Let’s add in one additional mortgage payment per year and see what happens.

By adding a single $1,400 payment per year, that drops you to $585,230 over the life of the loan. That’s another $50,000 in savings.

Conclusion

As you can see the U.S. Mortgage Calculator provides you with essential information to not only make an informed decision about which mortgage is right for you but also methods to save HUGE money.

There’s no better motivation to save and make extra payments than to see these drastic changes on a mortgage calculator.

If you have a favorite calculator that I missed I’d love to hear about it.