This post may contain affiliate links, which means I may earn a small commission at no extra cost to you if you make a purchase through one of these links. Thank you for your support! Read full disclosure.

Frustrated about your credit score and how you can improve it? You’re not the only one! Check out this comprehensive guide to understanding and improving your credit score.

I’ll walk you through everything you need to know about improving your credit score to a number you’re comfortable with.

Table of Contents

3 Very Important Digits

Many people don’t realize that your credit score is one of the most important 3 digit numbers of your life. It tells potential lenders your creditworthiness, which essentially gives them insight into how responsible you are with credit.

Credit scoring is used by creditors and lenders to decide if you are “worthy” of them lending you money or approving your loan application.

This grid below illustrates how a low credit score can cost you hundreds of dollars more each month on your mortgage.

A low credit score can result in a high interest rate which ultimately costs you more money.

Unfortunately, there is no hiding from your credit problems. If you are one of those people who’s been struggling with bad credit it’s time you learn what goes into determining your credit score and the steps you can take to improve it.

Knowing what’s in your credit report and how it works will help you understand what you can do to improve your credit score.

What Is A Credit Report?

If you are 18 or older and have had a credit card, loan, or debt collection, then you likely have a credit report. A credit report can be viewed as your financial report card where it grades you on how well you manage your finances.

You’ve probably heard something about a credit report when applying for a new rental house or apartment, or possibly even a new job. It’s a record of information about the way you handle your credit and debt accounts.

It includes information about how much debt you’ve accumulated. To who and how much debt you owe, how much you paid and most importantly how efficiently you paid those debts.

In other words, they track if you were on time with your payments and if you made any late payments. The biggest red flag to any lender is when you forget to pay the bill altogether.

Your credit report will include where you currently live along with prior addresses. It includes where you work, and if you’ve filed bankruptcy or had a lawsuit filed against you.

It will also have record if you’ve ever foreclosed on a home or had a vehicle repossessed.

Being that your credit report is something that lenders use to approve or deny pretty much your whole future. It’s a good idea that you regularly check your credit score.

By checking your credit score you will have an idea of what lenders are seeing when they pull your credit.

And by reviewing your credit reports it allows you to check for errors that might be lowering your credit score, and it can tip you off to potential identity theft.

You can use the dispute process to get mistakes removed, which may help you qualify for credit or get better terms on loans you’re applying for.

Getting Your Credit Report

There are 3 main bureaus in charge of reporting your credit

- Equifax

Experian Transunion

These 3 bureaus have a record of all your basic personal information such as your Social Security number, birthdate, current and former addresses.

In addition, your credit report will most likely contain:

- Variations of your name (maiden, married)

- Date you opened various accounts

- The type of account (real estate, revolving, installment)

- Your Employer

- Open and Closed Accounts

- Account Payment History

- Recent Credit and Loan Applications

- Collection Accounts

- Public Records

Most public records and collections stay on your report for no more than seven years however bankruptcies may remain for up to 10 years.

On each report there is a code used that is used to tell a lender if your account is current, or delinquent. They can go as far to say if you are past due by thirty, sixty or even ninety days.

Every credit report should also list the addresses and telephone numbers of your creditors, which you can use to contact them to dispute any inaccurate information.

How Do Credit Bureaus Collect Information?

Most major creditors have to subscribe to at least one or more credit bureaus. When they do this the creditor sends regular updates to the bureau about your open accounts.

The creditor is responsible for supplying the credit bureau with current account information on its customers. Usually, this information is shared to the bureau on a monthly basis and it’s the bureau who updates each borrowers credit file.

You may find that your credit reports vary between the 3 different bureaus and this is because they all use different sources for obtaining your information.

There’s no use in trying to escape the credit bureaus…. They’ll find you ( I know… sorry). They use your current and past creditors to obtain your information they also depend on banks and public court records to provide them with your history.

How To Get Your FREE Credit Report?

1. Go to AnnualCreditReport.com

Annual Credit Report is a governmentally mandated site that entitles you to one free credit report from each of the 3 different bureaus once a year.

Be Aware….

There are tons of advertisements that claim to provide free credit reports and credit scores. They are not always free. These companies tease you into signing up with them and make you pay to access the information you are trying to get.

Annualcreditreport.com is absolutely FREE and is the site I recommend you use. The site you want looks like this:

2. Enter your personal information

You’ll need your basic personal information name, Social Security number, address and birthdate.

3. Request a credit report or reports

You can order one, two, or all three reports.–(for our instance since we are determining your baseline, I recommend you get all three.)

However, I don’t always recommend getting all three at one time because I prefer to rotate between the three companies getting a free report each quarter.

4. Successfully answer security questions about your credit history

For each report requested, you’ll be asked a few questions about your finances that are personal to only you. Sometimes answering these questions can be a bit tricky especially if some of the accounts are several years old.

If you can’t recall the details they are asking it’s probably best to request your reports by mail or phone; this process doesn’t require security questions.

5. Generate your credit report online

My first bit of advice when accessing these reports online is to print them out. I advised my mom to go to Annual Credit Report to check her report and whatever she did she lost access to all 3 of the reports without printing them.

Make sure to print or save to your desktop so you don’t lose your access after logging off the system.

If you need to request a credit report by mail or phone, call 877-322-8228 or send a request form to the address below. You can expect to receive your credit report within 15 days.

Annual Credit Report Request Service

P.O Box 105281

Atlanta, GA 30348-5281

How To Review Your Credit Report .

After you have received your FREE copies of your credit report from the 3 different bureaus look them over thoroughly.

Why do you request your report from all three bureaus? Remember I mentioned that there may be slight variances between all 3 reports and we want to get a clear picture of your whole financial story.

If one report has a delinquency that the other does not have we want to know about this.

Can You Get More Than 1 Credit Report Per Year?

You are entitled under federal law to receive one report from each of the 3 bureaus in 12 months. However, if you are looking to access your report from any of the 3 bureaus more than once a year the credit bureaus can charge you up to $11.50 per report.

Did you know that there are certain instances that entitle you to additional free credit reports throughout the year? Here are the instances under which you can request additional reports:

If An “Adverse Action” Has Been Taken Against You

Under the F

If You Have Ever Put a Fraud Alert on Your Credit Report

If you’ve place a fraud alert on your credit report, the credit bureau must give you a free copy of your report.

If You’ve Been A Victim of Fraud

The Federal Fair Credit Reporting Act gives you the right to request a free copy of your report if you can certify to the credit bureau that you believe your credit report contains inaccurate information due to fraud.

If You Are Unemployed

If you’ve lost your job and are unemployed you are entitled to a free copy of your report if you can certify to the credit bureau that you will be applying for employment within 60 days.

The 3 Credit Bureaus Contact Info

Equifax

Address:

Equifax Disclosure Department

P.O. Box 740241

Atlanta, GA 30374

Experian

You can request your free report due to fraud on Experian’s website. Other requests must be made by mail.

Address:

Experian

P.O. Box 2002

Allen, TX 75013

TransUnion

TransUnion’s website has a form you can print, fill out, and mail.

Address:

TransUnion LLC

P.O. Box 1000

Chester, PA 19022

Tip: Transunion’s phone system can be a bit confusing. There are multiple prompts to try and get you to purchase a credit score or credit monitoring service.

For this reason, I recommend you print the order form online and request your copy by mail.

How Does Credit Scoring Work?

Your credit score is that important three-digit number that summarizes your credit history. Again this helps a lender evaluate your creditworthiness; it’s their goal is to evaluate how risky you are to the borrower.

The most popular type of credit score is the FICO score which ranges from 350-900. Anything that is over 750 is considered to be very good by most lenders

If your credit score is not at the level you would like it to be, you should start by checking your credit reports for errors. If you are in the process of applying for a new line of credit and having difficulty being approved perhaps you can try explaining why your credit score is lower than you would like.

It may be something like… You had a financial hardship due to a job loss and a decrease in salary that caused you to default on a credit payment.

Your creditor can’t do much to change your credit score however by thoroughly explaining your situation they may choose to grant you a new line of credit by overlooking your credit score if they feel your explanation is warranted.

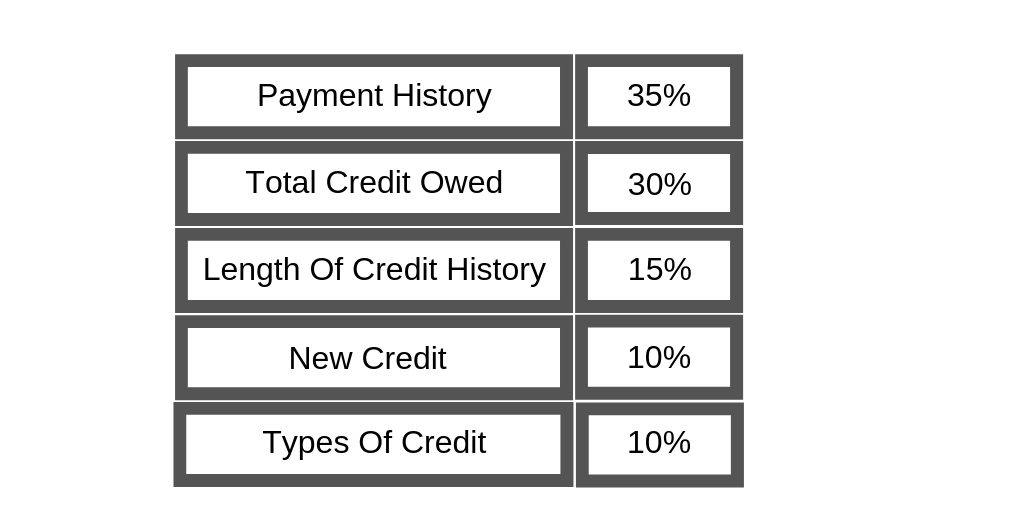

What Are The Credit Scoring Factors?

Each bureau has slightly different information that they have gathered about you and your credit history and the way they calculate your score varies a bit also. This is why each bureau may have a slightly different score.

The good thing is the credit scoring company FICO has disclosed the most important factors in generating credit scores.

Improving Your Credit Score

Writing about the various ways to improve your credit really could be an article on its own because there is so much that goes into improving your credit.

When you pulled your credit you should have noted any areas that stood out as “critical or bringing you down”. These are the areas that are hurting your score the most and are the areas you should begin focusing on to improve that particular area.

The one thing you need to do right now to start improving your credit is to begin paying your bills on time and to keep your credit balances low.

How To Get Your Credit Score for FREE

Just like obtaining a copy of your credit report your credit score can be tricky to get for FREE if you don’t know where to go.

There are many credit card companies that are beginning to offer free monthly credit score checks. If you have a credit card I recommend checking with them first.

Two of my credit cards have this feature and it’s very nice to track monthly. If you are looking for a reliable and FREE place to get your credit score I recommend you go through Credit Sesame,. Not only can you get your credit score for free, it will alert you via email if anything changes on your credit report.

A Beginner’s Guide To Understanding And Improving Your Credit Score

I hope that you found this guide helpful. Are you struggling with your credit score? Don’t hesitate to reach out and maybe I have some pointers to help you get to where you want to be financially.

Don’t forget to share and pin for later! While you’re there, I’d love for you to follow me on Pinterest