Have you ever taken the time to actually think about how credit cards work? Or how to use a credit card responsibly? I know I know for some these seem like such elementary questions. But for others, these simple questions can help you to become a responsible credit card holder and even keep you out of debt.

When it comes to credit cards people have some pretty strong and varied opinions. Some say you should never have a credit card. Some say heck, why not- the more the merrier!

Let’s get down to some of the basics of credit card usage and discover if credit cards are right for you.

Table of Contents

What Exactly Are Credit Cards?

A credit card allows you to borrow money from a bank to make purchases pretty much anywhere. Whether you’re buying a dinner at a restaurant or a round trip ticket to Hawaii a credit card can extend you a line of credit to make the purchase.

As long as you practice a bit of responsibility and pay back the borrowed money within the “grace period”- typically 25-30 days you won’t have to pay any interest (extra money).

Unfortunately, if you aren’t responsible and begin making too many purchases and aren’t able to pay the full balance you end up paying interest.

It’s the interest with credit cards where people get themselves into trouble. When you start accruing interest it can quickly add up to a large chunk of money that can get out of hand quickly.

Interest is a percentage of the money you owe the bank on top of what you borrowed

What Is A Credit Card Account?

A credit card is a revolving line of credit that allows you to make charges up to your credit limit. You can think of credit cards as a short term loan, and I mean really short- like a month (the grace period), don’t get carried away.

Every time you swipe your credit card the credit card company is loaning you money to make that particular purchase. The difference between a loan and a credit card is that credit cards don’t have a fixed end date and regular monthly payments that are due.

This is where a lot of people can get themselves into trouble.

It’s up to you to decide how much you repay each month. You can pay the minimum amount due, a partial payment, or be a responsible credit card holder and pay it in full every month. Please choose the latter of the three!

What Is A Grace Period?

Grace periods are that little window of time typically 25-30 days that you get to use your credit card without being charged interest. If you pay the total amount due each and every month you won’t accumulate interest on the purchases you made.

The problem people run into is when they only pay the minimum amount due each month. When this happens you start to accumulate more and more debt sending you into a bit a downward spiral.

It’s really important that you commit to paying off every single penny that you were loaned. In addition to accumulating debt by not paying your credit card; you can cause your credit score to plummet because of your credit utilization which we’ll discuss in a bit.

What Is Credit Card Interest?

One of the most important features of a credit card is the interest rate. Simply put, this is the price you pay for borrowing money. Credit card interest is generally charged as a percentage of your balance each month.

The percentage of interest you owe each year is called your annual percentage rate or APR for short. Most often your APR will be anywhere from 0% to 24.99%, this all depends on your credit score and history. Which is why keeping your credit score in tip top condition is so important.

When paying off your credit card you typically have a grace period for repaying your balance before you are charged interest on the borrowed money.

Sooooo the best thing you can do for yourself is to pay your balance in full each and every month and you won’t have to pay any credit card interest.

Sounds pretty easy right? The problem happens when someone ends up racking up $100 on their credit card but only pays $50 to the credit card company. When you do this you accrue interest on the remaining $50 until you’re able to repay it.

What Are Credit Card Fees?

When you start using credit cards it’s really important to understand just how credit cards work. You need to understand the fees that are associated with having a credit card.

This is really important don’t gloss over this section! Some credit card companies charge you an annual fee, their nice way of charging you money for giving you the privilege of using their card. Yep, more money out of your pocket. Depending on your credit card, you could face an annual fee of anywhere from $0 to $500.

Additional Fees When Using Your Credit Card

- Late Payment fees– Just as it says if you don’t make your payment on time you have to pay a fee.

- Balance Transfer fees-This is a credit card fee that is charged when you use one credit card to pay off the balance of another credit card.

- Foreign Transaction Fee– You pay a fee for any purchase you make outside of your domestic country. If you are a frequent traveller you will want to make sure you have a credit card that does not charge foreign transaction fees.

What Are The Different Types Of Credit Cards?

When looking to get a credit card there are 4 common types to choose from.

- Rewards Credit Card

- Low Interest Interest Credit Card

- Balance Transfer Credit Card

- Secured Credit Card

Key Features Of Credit Cards

Rewards Credit Cards: A rewards credit card, gives cardholders rewards for making purchases on their credit card. Rewards are paid out in a variety of ways, such as cash back, airline miles, free hotel stays and even gift cards.

Retail Cards: Store credit cards are great for saving money on purchases at your favorite retailers. They’re known for offering generous first-purchase discounts and enticing rewards. These cards are issued by a retailer rather than the credit card company or bank.

Balance Transfer Credit Cards: Balance transfer cards are good for those who have a decent amount of credit card debt. They allow consumers the ability to transfer their high credit balance to a new credit card with an interest free period.

Secured Credit Cards: These cards are a good choice for people who have bad credit. Secured credit cards require you to deposit cash that is then used as collateral against the credit card balance. These are a great option for those who need to rebuild their credit. The great thing is they are easy to qualify for due to the secured deposit.

Build Credit With A Credit Card

Did you know that by being a responsible credit card holder you can actually improve your credit score? It’s true, by getting a credit card and putting a couple of purchases on it each month and paying it off in full you can actually improve your credit score.

The reason that this improves your credit score is that lenders like to see you are responsible with handling both loans and credit cards. Diversification is the key when it comes to your credit score!

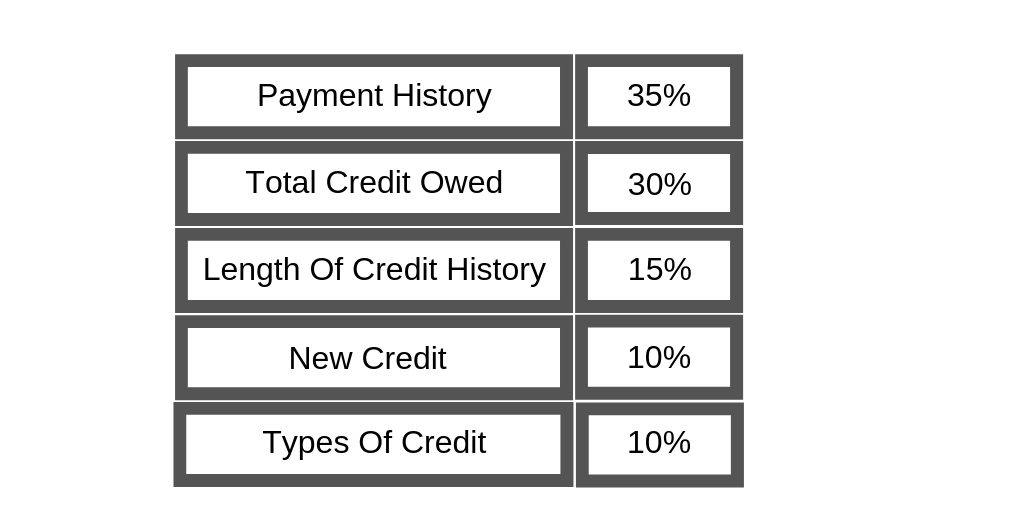

5 Different Factors Used To Determine Your Credit Score

How To Use And Manage A Credit Card

Always always always be responsible when handling your credit cards. It can seem so easy to swipe it everywhere you go but sooner or later it will catch up to you.

By not paying attention to your credit card usage you can end up in debt or with a credit score that’s in the tank. When your credit score is less than desired it makes it difficult to get good rates on car loans, home loans and even new credit cards.

The number one thing you can do is to pay your bill on time and in full every single month.

RELATED:

- 5 Smart Ways To Improve Your Credit Score Quickly

- Credit Card Disputes-Everything You Need To Know To Come Out Ahead

- A beginners Guide To Understanding And Improving Your Credit Score

Tips For Using Your Credit Card

1. Do not miss a payment

The number one reason people have poor credit is because they forget to pay their bill. By consistently missing payments you can end up paying hundred of dollars in fees.

2. Pay your bill on time

Avoid all fees by paying on time.

3. Understand your billing cycle

The billing cycle for a credit card is the period of time between billings. Make sure you are knowledgeable in this area.

For example, a billing cycle may start on the 1st day of the month and end on the 30th day of the month. Credit card billing cycles vary in length but usually ranging from 27 to 31 days.

4. Pay your bill in full

Always do your best to pay the balance off in full. Doing so assures you that you will not accrue any interest or fees. It also helps you to build your credit.

5. Keep your balance low

Having a low credit card balance is key when trying to increase your credit score.

Credit utilization is a piece of the puzzle the creditors use when determining your credit score. Credit utilization is the ratio of what you owe to the amount of credit available to you.

Most financial experts recommend keeping your credit utilization ratio at 30% or less.

For example if you have a credit limit of $1000 and you have $500 on the card your utilization ratio would be 50%

Final Thoughts

It’s true, credit cards can be a tricky if you don’t know what you are doing. But I honestly believe that you can use a credit card and never have to pay an extra penny in fees or charges.

Take your time figuring out how credit cards work and exactly how they can benefit you. If you have questions please don’t hesitate to ask!

Don’t forget to share and pin for later! While you’re there, I’d love for you to follow me on Pinterest

Hi, for two years I had $95,000 in debt, including $36,420 in credit card debt. My credit score was nothing to write home about. I managed to get most of my debt removed in bankruptcy and i was left with $7,000 car loan and $51,000 in student loans. Determined not to repeat my mistakes again I was recommended by a credit consultant to contact 760PLUS CREDIT SCORE who would help fix my credit score and clear my loans she referred me to her hacker friend she has met years ago who specializes in fixing credit score. I contacted him through [email protected] the following day, it took him some time to get back to me, because he was fully book, after a while he responded and helped me out. He started from raising my credit score to 799 after which he cleared my outstanding pending bills. I bounced back quickly, I am currently on my feet and on my way to buying a house. All thanks to 760 Plus. You text : +1(304)-774-5902.