This post may contain affiliate links, which means I may earn a small commission at no extra cost to you if you make a purchase through one of these links. Thank you for your support! Read full disclosure.

So you’re looking around and thinking its time to begin planning for your retirement. You’ve heard the terms Roth IRA, and Traditional IRA and now you’re curious – What’s the difference?

When looking into investment options for your future it’s a good idea to take a look at the pros and cons of a Roth IRA vs. a Traditional IRA. Both are great investment vehicles but knowing which one is right for you is what this article is all about!

People often neglect the use of tax incentivized accounts for early financial independence. Did you you know that doing so could be a big mistake? Yes, it’s true, an IRA is a tax incentivized account. These accounts are the governments way to encourage people to save money by reducing the amount of taxes they have to pay.

By saving for your IRA now you are putting money into a retirement account that will grow grow grow! We all want the opportunity to achieve financial independence sooner vs later right?

This article may contain affiliate links, full disclosure here

Be sure to read our Comprehensive Guide to Financial Independence for more great tips of investing options.

So…. Let’s Begin. What Is AN IRA?

An IRA is an Individual Retirement Account. It’s an alternative retirement option for you to utilize outside of your employer sponsored retirement accounts, like your 401(k), remember when we talked all about that it here?

An Individual Retirement Account (IRA) is just as it sounds, for the individual created by the individual. Instead of by the employer such as in a 401(k).

What Is A Roth IRA?

Roth IRA’s are individual retirement accounts funded by after-tax income up to a specified amount each year. There are no tax breaks for contributions made to the ROTH account. Your tax benefit comes in the form of tax-free withdrawal as well as tax-free growth.

What Is A Traditional IRA?

With a Traditional IRA, contributions are tax deductible in the year they were made. You will not pay taxes on your contributions but you will pay tax later on withdrawal. The account also grows tax-free.

Should I Open an IRA?

Yes, yes and yes! For many people, retirement planning consists only of their employer’s retirement plan such as a 401(K). While these are a great option, this means that most people won’t start saving for retirement until later in life.

All those years of investing in your retirement were missed. IRAs are a great way to start the retirement savings process early.

Many people foolishly think tax-advantaged accounts are not a good option for early retirement because they penalize withdrawals prior to traditional retirement age. This is not the case and I will show you why.

But first make sure you are tracking your spending. We use and swear by Personal Capital and promise it will make a big difference in your savings. It’s also great for tracking investment accounts such as IRAs.

Tax Incentives

Both Traditional and Roth IRA’s offer significant tax breaks and allow for tax-free growth.

Traditional IRA

- Traditional IRA contributions are tax-deductible for both state and federal taxes. This means you don’t pay income tax on the money you contribute. If you make $100,000 a year and contribute $5,000 you only pay income taxes on the $95,000. Once you retire you will pay taxes on the withdrawal.

- This can benefit you if you think your taxable income will be greater during your investment years than your retirement years

Roth IRA

- Roth IRA contributions are different in that you pay taxes upfront but withdraw at retirement tax-free.

- This may benefit you if you think your taxable income will be greater when you retire than your investment years.

With both accounts you get tax free growth!

2018 IRA Contribution Limits

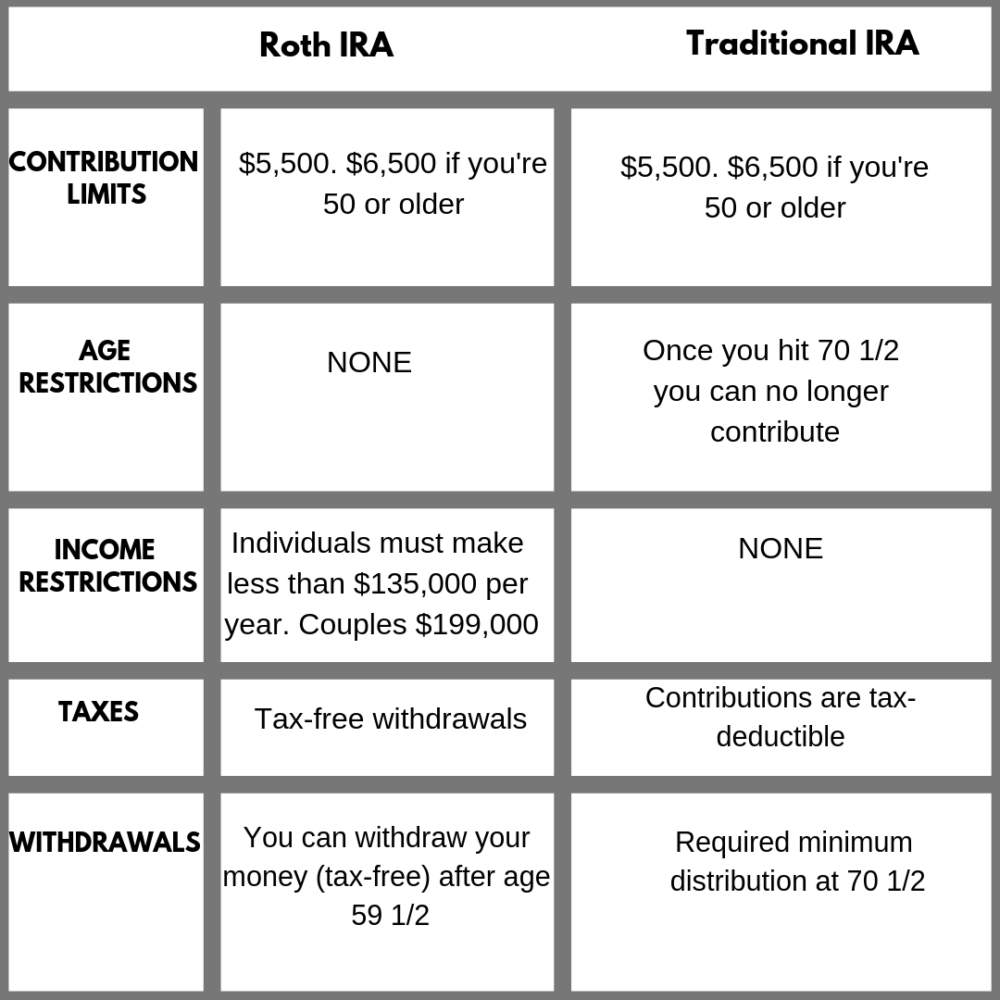

- Both Traditional and Roth IRA have contribution limits of $5,500, $6,500 if age 50 or older

2018 IRA Income Limits

- Roth IRA – Single tax filers $135,000, joint filers $199,000

- Traditional – Anyone with an income can contribute but tax deductibility varies based on income.

Roth IRA vs Traditional IRA Withdrawal Rules

A difference between Traditional IRAs and Roth IRAs is when the savings must be withdrawn.

Traditional IRAs require you to start taking required minimum distributions (RMDs) at age 70½. These are mandatory monthly withdrawals, whether you need the money or not, and are a certain percentage of your total balance.

Roth IRAs, on the other hand, do not have a required minimum distribution (RMD). They may grow tax-free indefinitely if you don’t end up needing the money during retirement.

This is a big plus as you can leave this fund intact to your beneficiaries who won’t have to pay income tax on withdrawals.

Both Traditional and Roth IRAs allow for penalty-free distributions at age 59½.

Additional Considerations

Roth IRAs

- Roth contributions (not earnings) can be withdrawn penalty and tax-free at any time, even before age 59½.

- You can withdraw up to $10,000 of Roth earnings penalty-free to pay for qualified first-time home purchases. You must have had the Roth for at least 5 years to qualify for this.

- There are a few additional early withdrawal options such as disability and details for those can be found here.

Traditional IRAs

- Traditional IRAs lower your taxable income and may help you to qualify for various tax incentives.

- You can withdraw up to $10,000 penalty-free to pay for a qualified first-time home purchase, medical expenses, and education expenses.

- Remember you will still pay taxes on the distribution for any of the above.

Why Should I Choose A Roth IRA or Traditional IRA

Regardless of whether you choose to invest in a Roth or Traditional IRA, you’ll get some type of tax break on your contributions. The choice is yours!

With a Traditional IRA, you get a tax break in the year you contribute the money. With a Roth, you’ll pay taxes on the income you earn and contribute upfront, but you won’t pay any taxes when you withdraw it later.

We’ve outlined the differences and you can see that both may have advantages over the other. Deciding between a Traditional and a Roth IRA depends, basically, on how you think your income or, your income tax bracket—will compare to your current situation.

A Traditional IRA often makes sense if your tax rate will go down in retirement. This is often the case for many people who are nearing retirement and have already experienced their salary peak. Therefore you can save money by putting off paying taxes until you qualify for a lower rate.

The Roth on the other hand has some nice flexibility to it in terms of withdrawing your money early.

LET’S THROW IN ONE MORE VARIABLE, FINANCIAL INDEPENDENCE/EARLY RETIREMENT (FI/RE)

What if I want my IRA money before 59 1/2?

[click_to_tweet tweet=”How to fund early retirement with an IRA? Hint: there’s a trick” quote=”How to fund early retirement with an IRA? Hint: there’s a trick”]

Roth Vs Traditional IRA Which Is Best For Early Retirement?

Both IRA’s are certainly better than a standard taxable investment account where you get taxed on your growth.

However, did you know that a Health Savings Account (HSA) may be the ultimate early retirement account? We discussed everything an HSA can offer here.

Taxable Account

But Wait…..There’s a better way!

Choosing between the two basically comes down to when you want to pay your taxes, before(Roth) or later (Traditional).

What if we could have the best of BOTH worlds similar to an HSA? Investment, growth, and withdrawal tax-free!

Actually, there are two ways but only one we like

We have two options to get around the 10% penalty for early withdrawal before age 59.5.

1. The 72t Rule (SEPP)

Also known as Substantially Equal Periodic Payments or SEPP. Here’s a quick overview of what this is about.

- 72t allows you to withdraw around 3-4% of your tax-deferred assets each year following a strict set of IRS rules.

- It requires a long-term commitment to this schedule and provides little to no flexibility without penalties. You must maintain this plan till you’re 59.5 and if you screw up the withdrawal plan they will back-tax you 10% all the way back to the start.

While SEPP might be a great option for some and certainly worth looking into, it isn’t our first choice.

Instead, we opted to climb the conversion ladder.

2. Roth IRA Conversion Ladder

This ROTH conversion ladder along with an HSA is our key to Financial Independence Retire Early (FIRE)

There’s an IRS rule that allows any money converted from Traditional IRA to a ROTH IRA to be withdrawn penalty free and tax free. With two catches…

- The first is that you must wait 5 years (or hit age 59.5) after the conversion before you can withdraw penalty free

- The second is that you have to pay taxes at the TIME of conversion.

How To Do The Roth IRA Conversion Ladder

1. Contribute to your Traditional IRA or 401(k) Tax-deferred account

- During your working years max out your Traditional IRA or 401(K). Because this will likely be your highest income tax bracket years you will protect yourself from taxes by deferring till your later years.

Once you hit your early retirement date….

2. Start converting your Traditional IRA/401(k) to a Roth IRA

- At this point, you should have less taxable income than when you were actively working.

- Because you didn’t pay taxes in the beginning with your Traditional IRA you will have to pay taxes when you convert to a Roth.

- Because your taxable income during retirement is low or even zero after deductions, you may get this money tax-free.

Why This Works Well For Early Retirees

To make this work you need a period where your income rate is low so that you can roll your money over from Traditional to Roth without heavy income-related taxes. This is typically the pattern for early retirees.

Let’s take my husband and I for example. We will be working with high-income levels investing fully into our Traditional IRA.

At early retirement, our income will bottom out as we no longer have our job income. We now start rolling over our Traditional to a Roth while our income is low, thus saving us on taxes. 5 years later we can then start pulling from our Roth.

Here Are Some Numbers

Let’s say you convert $30,000 from your Traditional to Roth IRA in 2018. That $30,000 will show as ordinary income for 2018 and you may have to pay taxes depending on other income and filing status.

Remember you did not pay taxes on it initially. Fast forward 5 years to 2023. That $30,000(not any earnings) is now available for withdrawal. Start the same process in 2019 and you will have cash in 2024, repeat each year and you are now climbing the ROTH IRA conversion ladder.

As you can see IRAs are extremely important for not just traditional retirement but early retirement as well. These accounts along with an HSA should be maxed out each and every year. Don’t make the mistake of investing only in taxable accounts for your early retirement.

You might be asking how do I fund my early retirement during those 5 years before my ROTH ladder is available. This is where some taxable investment savings or my personal favorite the HSA are going to come in handy. Beginner investing will get you going on some great taxable investment strategy.

ROTH Ladder Taxes

In general, taxes can be extremely low using this process. 3% is about where we are planning. If you have kids you can likely get that to zero! The Turbo tax estimator can get you an idea of your actual tax numbers.

I highly recommend reading our previous article on Health Savings Accounts (HSAs) and how they may be the ultimate IRA for early retirement.

Additional readings

- A plan for early retirement

- Health Savings Accounts (HSAs)

- Best investment companies for beginners

- 13 Things You are Wasting Your Money On

I was recently asked if I would recommend Acorns for their new IRA investment options. While I like and use Acorns for the round-up savings, I would recommend starting an IRA through Vanguard. You can read more here about our recommended investment companies.